WASHINGTON (MarketWatch) – A move to extend the Federal Reserve’s Operation Twist program remains an option on the table, said Dennis Lockhart, the president of the Atlanta Federal Reserve Bank on Wednesday. Lockhart’s comment came in a discussion with reporters after a speech in Fort Lauderdale, Fla. The Fed’s $400 billion Twist program, to extend the maturity of the central bank’s balance sheet, is now set to expire at the end of June. In his prepared remarks, Lockhart expressed more worry about the economic outlook, saying that risks to the economy “are gathering.” Lockhart said that he saw a higher probability of a negative influence on the U.S. economy coming from Europe than he did at the last Federal Open Market Committee meeting in April. Lockhart said his baseline forecast was for a continued, though modest, growth. If this no longer looks realistic, further Fed action “will certainly need to be considered.” The Fed must “maintain a state of readiness” to respond to financial and economic instability should the need arise. ~~~~NNNNN~~~

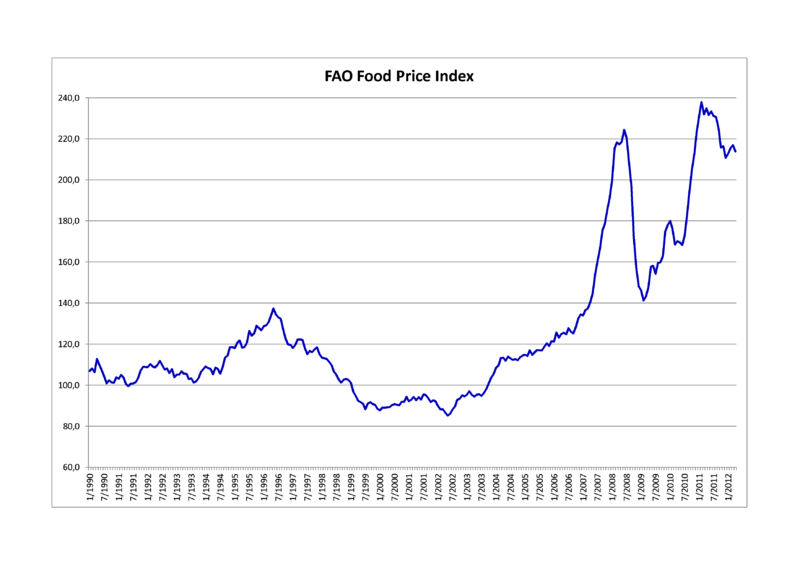

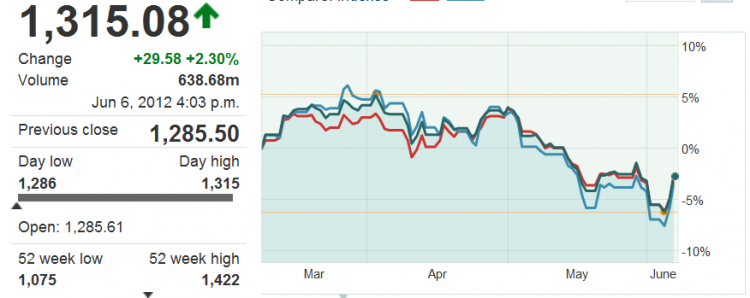

Meanwhile, the stock markets are all responding to the various ‘informal’ confirmations that more money will be printed. Remember – the value of a company doesn’t change just because more money was printed, so its share price must reflect the change. That is why stocks go up when money is printed, plain and simple. That is what happens to EVERYTHING when money is printed – the price goes up. It’s called INFLATION…

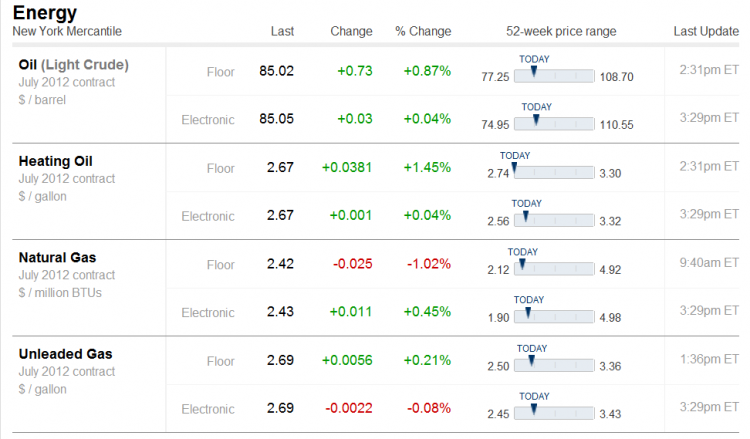

Lastly, you should be very concerned that energy is NOT TRACKING the anticipated inflationary printing impulse – it is still near 52-week lows. This very clearly declares that there is strong sentiment (market-babble for belief) that economic contraction is a reality, and that it is not going to get better. Where market forces are in play nothing stays the same, so if it is not getting better, then it MUST get worse…

Lastly, you should be very concerned that energy is NOT TRACKING the anticipated inflationary printing impulse – it is still near 52-week lows. This very clearly declares that there is strong sentiment (market-babble for belief) that economic contraction is a reality, and that it is not going to get better. Where market forces are in play nothing stays the same, so if it is not getting better, then it MUST get worse…

WE HAVE BEEN WARNED