See additional comments on Tea Party Nation

Congress votes to suspend the debt ceiling.

Today marks the close of the first week that Janet Yellen has been in charge of the Federal Reserve Bank. The stock market rose 2.28%, the price of gold rose 4.1% and the price of silver rose 7.45%. The market rise was mainly due to the continuation of the Fed’s stimulus even with tapering. Yellen’s comments below concerning unemployment were taken to mean that the printing presses will continue at breakneck speed.

The Russian Ruble has plunged to a record low and China has announced another shadow bank default. The European Union is considering the confiscation of the savings of the European Union’s 500 million citizens to fund long-term investments to boost the economy and help plug the gap left by banks since the financial crisis. The foreclosure rate on mortgages jumped 57% in California and 8% in the rest of the country.

Michael Snyder has outlined 20 signs that the global economy is about to catch fire (highly recommended reading). And I saved the best for last. Congress did not vote to raise the debt ceiling, they voted to suspend it completely until after the 2014 elections. As I continue to state, why does anyone believe that the political elites who have raped our country and Constitution will provide any solutions to return our fiscal stability?

David DeGerolamo

1. Yellen: ‘Too many Americans remain unemployed’

The Fed will continue reducing its stimulus as the economy gradually improves, Janet Yellen told the House Financial Services Committee on Tuesday.

Yellen, who was sworn in as Federal Reserve chair last week, stressed that she expects “a great deal of continuity” in Fed policy, following in the footsteps of previous Chairman Ben Bernanke.

Tapering will continue: The Fed has been concerned about lingering long-term unemployment, and is still trying to aid the economy by buying billions in bonds each month. That policy is meant to lower long-term interest rates, which stimulates more borrowing and spending.

2. Kazakh Devaluation Shows Currency War Stirring as Ruble Dips

Two years after Russia, Kazakhstan and Belarus formed a trade pact, a currency war is breaking out between the former Soviet republics.

Kazakhstan devalued the tenge by 19 percent yesterday, saying the Russian ruble’s plunge to a record low this month put additional pressure on its currency. The tenge will trade at 185 per dollar, with a range of 3 tenge on either side after a previous target of about 150, the National Bank of Kazakhstan said yesterday. The ruble fell to a record 41.0472 against the Russian central bank’s dollar-euro basket this month, dropping 6.3 percent this year and 15 percent from the start of 2013.

3. It Begins… Another High-Yield Chinese Shadow Banking Trust Defaults

While the eyes of the world were focused on the now infamous “Credit Equals Gold #1” Chinese wealth management product – it’s imminent default and last-minute bailout by ‘investors’ unknown – the coal industry in China continued to collapse (as we noted here). We noted at the time how bailing out current high-yield product investors would merely amplify the problems down the line and it seems that Chinese authorities have heard that message. As Reuters reports, a high-yield investment product backed by a loan to a debt-ridden coal company failed to repay investors when it matured last Friday, state media reported on Wednesday.

A high-yield investment product backed by a loan to a debt-ridden coal company failed to repay investors when it matured last Friday, state media reported on Wednesday, in the latest sign of financial stress in China’s shadow bank sector.

…

“It matured on Feb. 7, but CCB passed on an announcement from Jilin Trust saying ‘We currently can’t be certain when (Liansheng) funds will be returned,'” the official Shanghai Securities News quoted an unnamed investor in the trust product as saying.

4. Europe Considers Wholesale Savings Confiscation, Enforced Redistribution

At first we thought Reuters had been punk’d in its article titled “EU executive sees personal savings used to plug long-term financing gap” which disclosed the latest leaked proposal by the European Commission, but after several hours without a retraction, we realized that the story is sadly true. Sadly, because everything that we warned about in “There May Be Only Painful Ways Out Of The Crisis” back in September of 2011, and everything that the depositors and citizens of Cyprus had to live through, seems on the verge of going continental. In a nutshell, and in Reuters’ own words, “the savings of the European Union’s 500 million citizens could be used to fund long-term investments to boost the economy and help plug the gap left by banks since the financial crisis, an EU document says.” What is left unsaid is that the “usage” will be on a purely involuntary basis, at the discretion of the “union”, and can thus best be described as confiscation.

The source of this stunner is a document seen be Reuters, which describes how the EU is looking for ways to “wean” the 28-country bloc from its heavy reliance on bank financing and find other means of funding small companies, infrastructure projects and other investment. So as Europe finally admits that the ECB has failed to unclog its broken monetary pipelines for the past five years – something we highlight every month (most recently in No Waking From Draghi’s Monetary Nightmare: Eurozone Credit Creation Tumbles To New All Time Low), the commissions report finally admits that “the economic and financial crisis has impaired the ability of the financial sector to channel funds to the real economy, in particular long-term investment.”

The solution? “The Commission will ask the bloc’s insurance watchdog in the second half of this year for advice on a possible draft law “to mobilize more personal pension savings for long-term financing”, the document said.”

Mobilize, once again, is a more palatable word than, say, confiscate.

And yet this is precisely what Europe is contemplating:

5. “Foreclosure Rebound Pattern”: Foreclosures SUDDENLY Jump 57% In California (And Soar In Much Of The Country)

From Federal-Reserve-fueled bubble to debilitating return to reality – reality being a financial calamity – to Federal-Reserve-hyper-fueled bubble: that’s the US housing market over the last ten years. There are many places around the country, including some cities in Silicon Valley, where home values are now higher than they were at the peak of the last bubble. Of course, no one at the Fed or in government calls it “bubble.” They’re talking about the housing “recovery.”

But the excesses and speculators are back, and private equity funds and highly leveraged REITs are all over it, buying up every single-family home in sight, and now Wall-Street-engineering firms have come up with a new and improved contraption, a synthetic structured security that on its polished surface looks like that triple-A rated mortgage-backed toxic waste that helped blow up the banks. But this time, it’s different. The securities are backed by sliced and diced rental payments from single-family homes that are, hopefully, rented out [read…. Another Exquisitely Reengineered Frankenstein Housing Monster].

So wither this “recovery?”

Foreclosure filings – default notices, scheduled auctions, and bank repossessions – suddenly jumped 8% to 124,419 in January across the nation, according to RealtyTrac.

6. 20 Signs That The Global Economic Crisis Is Starting To Catch Fire

If you have been waiting for the “global economic crisis” to begin, just open up your eyes and look around. I know that most Americans tend to ignore what happens in the rest of the world because they consider it to be “irrelevant” to their daily lives, but the truth is that the massive economic problems that are currently sweeping across Europe, Asia and South America are going to be affecting all of us here in the U.S. very soon. Sadly, most of the big news organizations in this country seem to be more concerned about the fate of Justin Bieber’s wax statue in Times Square than about the horrible financial nightmare that is gripping emerging markets all over the planet. After a brief period of relative calm, we are beginning to see signs of global financial instability that are unlike anything that we have witnessed since the financial crisis of 2008. As you will see below, the problems are not just isolated to a few countries. This is truly a global phenomenon.

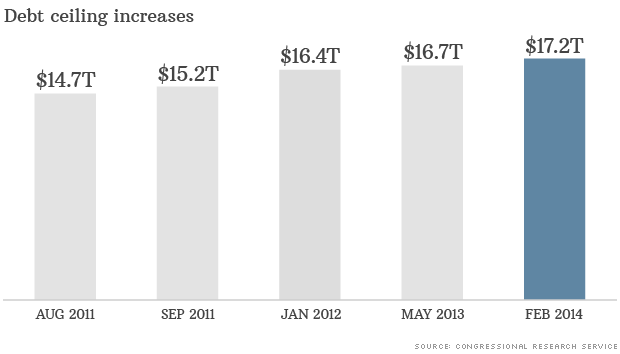

7. Where’s the debt ceiling now?

Lawmakers have decided to suspend the debt ceiling again — this time, at a level that’s now about $512 billion higher than it was last fall.

Here’s why: Suspensions have become lawmakers’ favorite way of “raising” the debt ceiling. They let Treasury borrow as needed to pay the bills and avert default. And when the suspension ends, the debt limit resets to the old cap plus whatever Treasury borrowed during the suspension period.

In other words, a suspension doesn’t technically raise the debt ceiling, but that’s the net effect.

The beauty for Congress is that lawmakers don’t have to go on record as voting for a formal increase by a specific dollar amount.

On Tuesday, the Treasury Department reported that the nation’s borrowing limit automatically reset to roughly $17.2 trillion, after the last suspension expired on Friday.