DXY:IND is the dollar spot index and GLD is the ETF for gold. The dollar spot index represents the value of our FRN vs. a basket of world currencies. Although the dollar has risen recently, this was an anomaly due to the collapse of the Euro. These two indices acurately reflect the state of our economy better than the stock market indices.

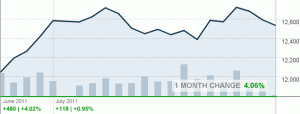

The stock market has risen 4.06% in the past month (courtesy of cnnfn.com):

That is an annual return of 48.72% which is not going to happen. No one believes that our economy is strong: in reality, the market is about to experience a drastic shift in direction. If we look at the value of the dollar since Friday (almost three trading sessions past), it has lost 2.99% which translates into a loss of 259% over the course of a year. This will not happen as the dollar would be worthless at a 100% loss. The reality is that the half of Americans who are supporting the other half who do not work just lost 3% of their life’s savings.

In this same period of time, gold has increased 2% and is up 7.7% over the past month. The chart below shows the dollar index’s decline due to the world’s response to our government’s spending addiction.

The financial world knows that a problem will never be solved by the people who are the root cause of the problem. As pointed out in a previous article, the debt ceiling is not the issue: the spending cuts required by Standard & Poor’s are not being addressed. Unless $4 trillion dollars is cut from spending over the next ten years, our credit rating will be lowered. The debt ceiling plans of the hour are only showing the world that we will not solve this debt issue so the dollar is devalued and the price of gold is automatically increased. As is the price of oil and housing.

Options are the same: gold, silver and the Swiss franc.

David DeGerolamo