That’s the advice from Fraser Howie, co-author of “Red Capitalism: The Fragile Financial Foundation of China’s Extraordinary Rise.” He says Chinese policy decisions are becoming “erratic” as authorities struggle to combat the nation’s deepest economic slowdown in more than two decades.

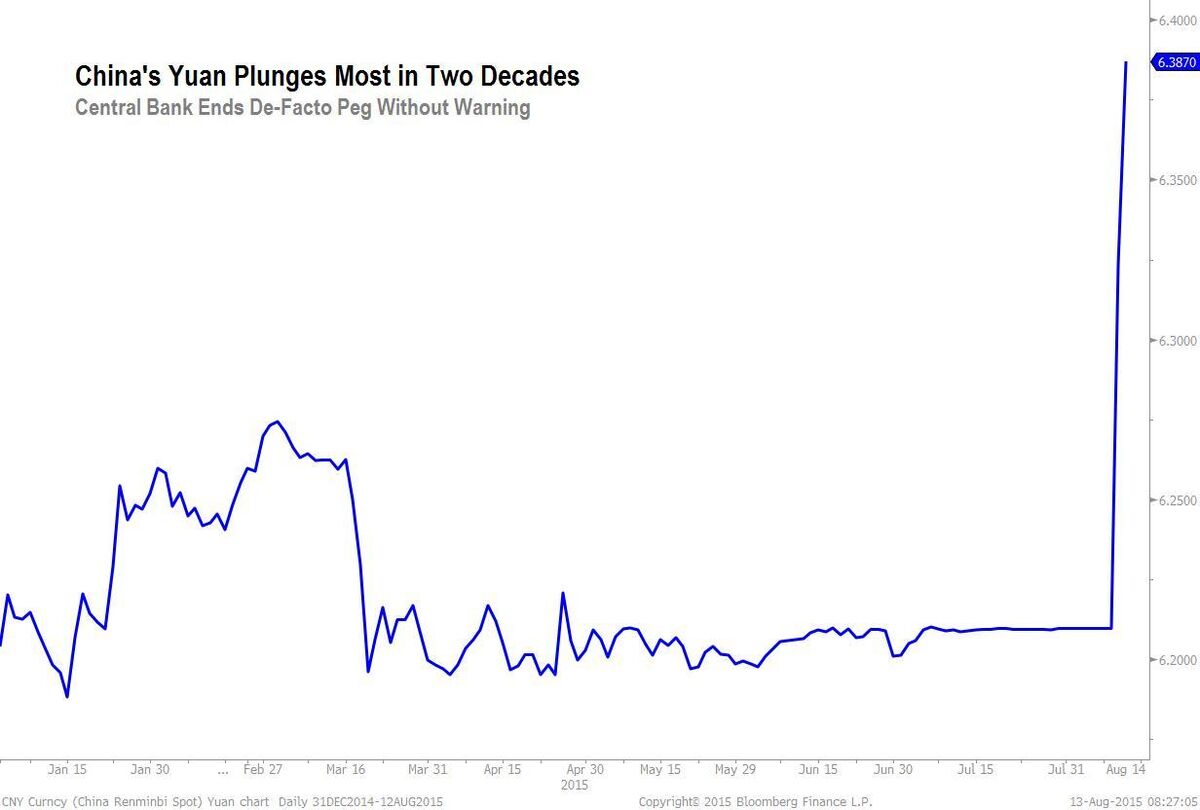

This week’s tumble in the yuan — the biggest devaluation since 1994 — comes just a month after unprecedented state intervention in the stock market deepened a $4 trillion sell-off. Two years ago, authorities triggered the country’s worst modern-day cash squeeze by restricting the supply of funds to the banking system. The failure of China’s decision makers to telegraph and explain those policy changes has increased volatility worldwide as traders struggle to forecast what happens next in Asia’s biggest economy, Howie said.

“This complete lack of signaling has investors, both foreign and domestic, completely spooked about what’s going on,” Howie, a former managing director at CLSA Asia-Pacific Markets, said in a phone interview from Singapore. “China has a huge influence globally and markets don’t like shocks.”