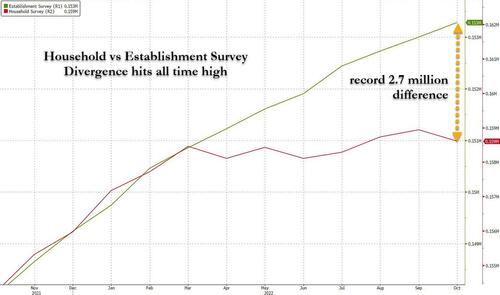

Regular readers are well aware that back in July, Zero Hedge first (long before it became a running theme among so-called “macro experts”) pointed out that a gaping 1+ million job differential had opened up between the closely-watched and market-impacting, if easily gamed and manipulated, Establishment Survey and the far more accurate if volatile, Household Survey – the two core components of the monthly non-farm payrolls report.

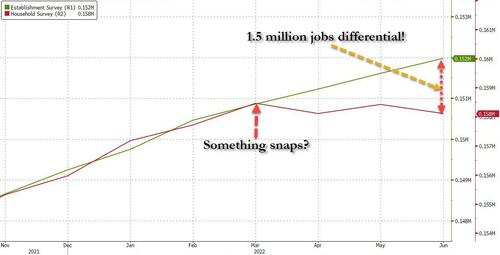

We first described this divergence in early July, when looking at the June payrolls data, we found that the gap between the Housing and Establishment Surveys had blown out to 1.5 million starting in March when “something snapped.” We described this in “Something Snaps In The US Labor Market: Full, Part-Time Workers Plunge As Multiple Jobholders Soar.”

Since then the difference only got worse, and culminated earlier this month when the gap between the Establishment and Household surveys for the November dataset nearly doubled to a whopping 2.7 million jobs, a bifurcation which we described in “Something Is Rigged: Unexplained, Record 2.7 Million Jobs Gap Emerges In Broken Payrolls Report.”

~~~~~~~~~~~~~~~~~~~~

I am at a loss to explain this discrepancy unless the nation is on the verge of collapse. Like within a short time frame of collapse. Why would the government fudge numbers for unemployment that would enable the Fed to raise the discount rate yet again when the country is already falling apart? And why would they then tell us that they lied shortly thereafter after the Fed’s nail in the coffin?

Something very bad is about to happen and I would bet money it will happen before the new Congress is sworn in. Keep your eyes open and your fiat currency close (not in a bank).

David DeGerolamo

This may be a little off topic. Would like to encourage those that visit this site to maybe subscribe here as well as your other information sources. Back up information that may someday disappear or be altered. At some point may require a digital Id to be allowed on line.

https://rumble.com/v1ztfhm-disturbing-proof-theyre-quietly-deleting-the-internet….html

Gasoline futures are down again. This indicates lower demand. Fewer jobs and less economic activity cause less demand for fuel. The end is near. I can smell it.

Today, lumber futures are at a 29 month low.

Trade in any excess Fiat for metals, gold, silver, or lead & copper And Stocked Food

But readers here already know this. Those that Need to know this aren’t here. Perhaps We should share links on other media.