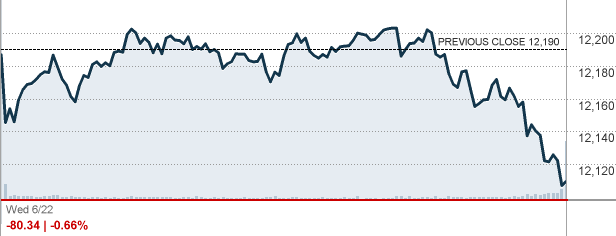

The following two graphs from CNNFN.com show a clear delineation between fantasy and reality. The first graph shows the stock market results for the past five days up through noon on June 22, 2011. Every day the market rose based on what can only be described as misinformation.

Does anyone believe that Greece’s economic collapse will not happen? The people in Greece know the answer and are taking to the streets. Spain and Italy are experiencing the “contagion” from Greece as their deficits are coming under further scrutiny. The price of oil is going down due to a worldwide economic slowdown. The housing market news in the United States is bleak. We have less jobs in the United States now than in 2000 but an additional 30,000,000 people are now living in our borders. But somehow, under all of this news, the media and administration spin our illustrious recovery in such a manner that the market rises.

That spin abruptly stopped today. Mr. Bernanke would be making an appearance today at 2:15 in Congress and I wanted to show how the market reacts when faced with incontrovertable evidence (otherwise known as reality) of the true economic picture.

The following excerpt will remind us what drives this administration’s economic policy.

A White House Seized By The Animal Spirits

White House Budget Director Peter Orszag is a numbers guy, a propeller head as President Obama would say. But as David Von Drehle and I write in this week’s print version of TIME, Orszag has been spending his time recently reading not about spreadsheets, but about psychology. In particular, he has been reading a new book by the economists George Akerlof and Robert Shiller called “Animal Spirits: How Human Psychology Drives The Economy, and Why It Matters For Global Capitalism.”

The book’s thesis is that modern economics has undervalued the role of the spirits–psychological phenomena like confidence, story telling, fairness and corruption–in shaping economic patterns. The root word of credit, they point out, is the Latin “credo,” meaning “I believe.” A credit crisis, therefore, can be understood as a crisis of belief. They write:

Economists have only partly captured what is meant by trust and belief. Their view suggests that confidence is rational: people use the information at hand to make rational predictions. Certainly people often do make decisions, confidently, in this way. But there is more to the notion of confidence. The very meaning of trust is that we go beyond the rational. Indeed the truly trusting person often discards or discounts certain information. She may not even process the information that is available to her rationally; even if she has processed it rationally, she till may not act on it rationally. She acts according to what she trusts to be true.

That is a near perfect description of what led to the current crisis. The bank barons, Federal Reserve chairmen, Congressional regulators, stock investors, home buyers, investment bankers, derivatives traders, the financial press and the general public all had an irrational confidence in the economy. From the captains of industry down to the neighbor next door, we spent more than we had because we believed. We discarded or discounted information that challenged this believe, most notably the ridiculously unprecedented spike in real home values.

The “economic recovery” never happened and now the events in Japan are being used as the scapegoat for the Federal Reserve’s inept handling of our country’s future. The blame game is not going to solve our problems. The looters (Congress and the president) in Washington can blame whomever they please but they will come to understand that playing us like a fiddle when the country catches on fire will have consequences.

David DeGerolamo

I agree reality sucks, but people need to start paying attention to it. Ive watched th mini crashes over the last yar in the market wuh the FR arifically pumping it back up, ugg. This trick will not last forever. In fact, I it’s coming to end. Can’t dig no deeper when your out of dirt.

Sounds like they’ve read True Globalization. It’s in the balloons, stupid. Keep ’em up.