As I write this article, the DOW is up 724 points. This comes after today’s report that the GDP in the first quarter dropped 1.4%.

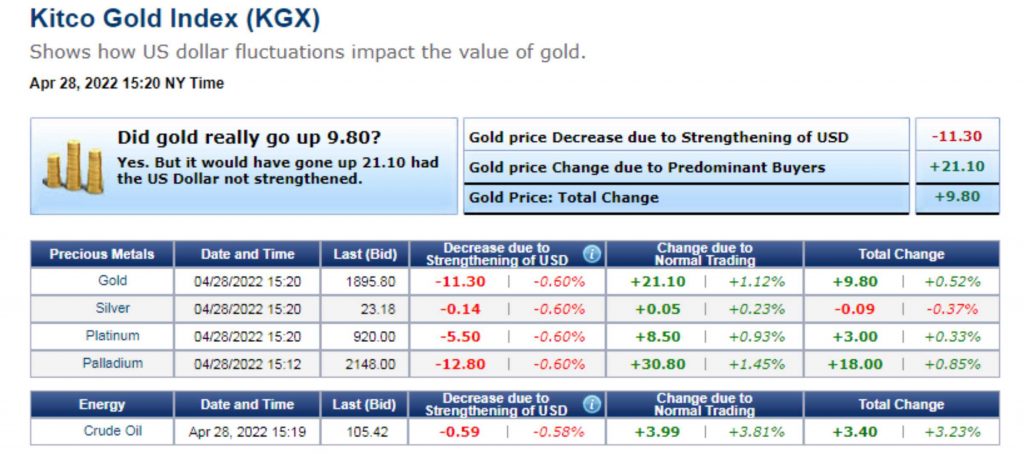

Gold is currently up $9.80 an ounce.

A closer look at this gold price shows strong world demand for both gold and the US dollar. If the dollar’s increased value was taken out, the price of gold would have increased $21.10 an ounce.

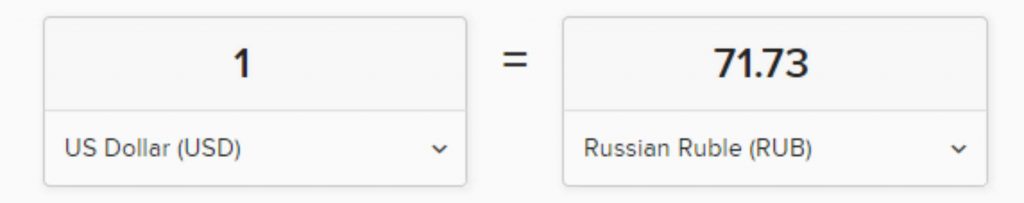

Normally, a strengthening dollar would show other currencies weakening against it. Let’s look at the Russian ruble against the US dollar:

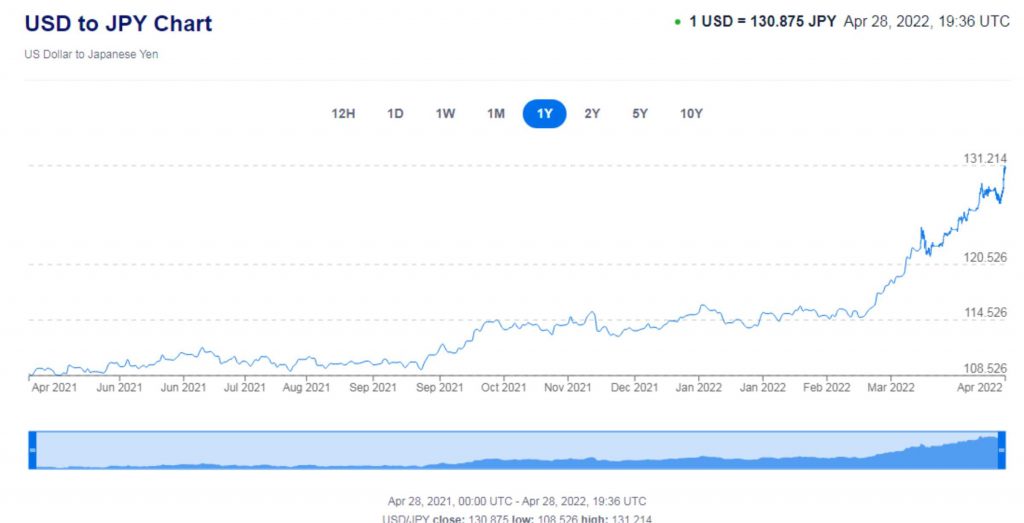

The above rate means that the Russian ruble has increased its value against the USD by 4% in the past 6 hours. One of the reasons for these increases is the collapse of the Japanese yen:

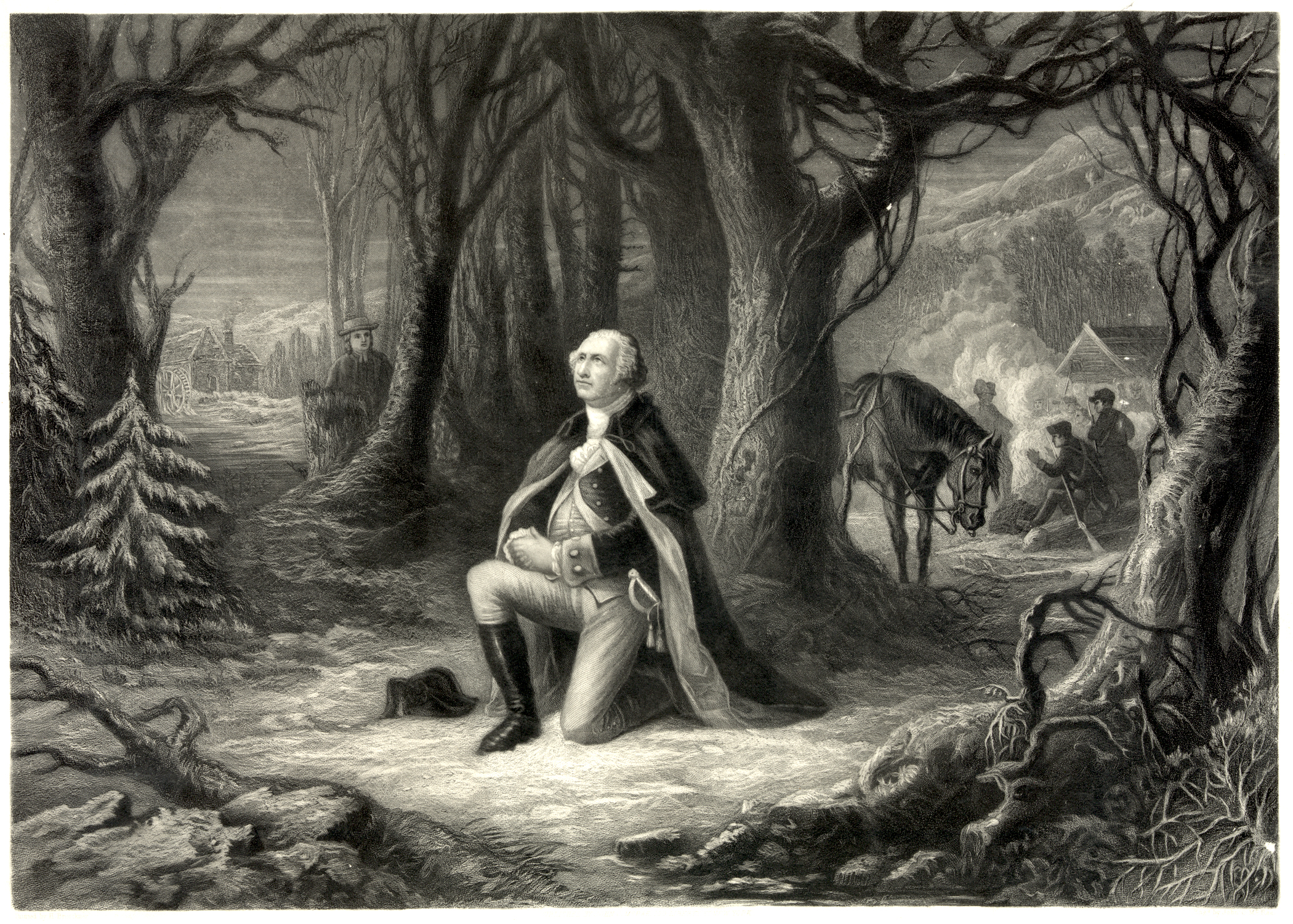

The yen has lost 15% of its value against the USD in two months. If you are starting to think that the USD is a good way to store your wealth, I suggest you go to the gas station or the food store. Inflation is turning into hyperinflation at the same time inventories are decreasing. What is the best path to secure your future? George knew:

David DeGerolamo

Amen to the real answer.

First thought Amen.

Second comment… I don’t know you David DeGerolamo but I hold you in high regard. I very much appreciate all the effort you put into this blog. And I especially appreciate articles like this!

Thank you kindly.