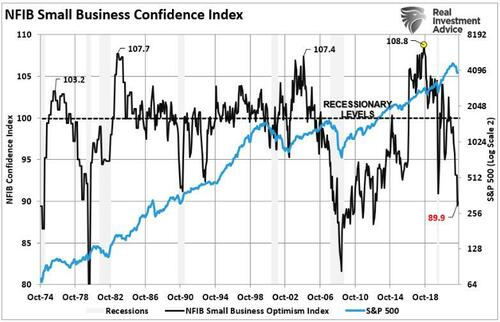

Since the last update in June, the NFIB Small Business sales and sentiment measures have only deteriorated further. Despite a surging stock market in July and August, along with suggestions the economy will avoid recession, the data continues to suggest differently if historical precedents hold.

For example, overall confidence expressed by the members of the National Federation of Independent Business (NFIB) owners is at levels that have historically correlated with deep recessions and bear markets.

…

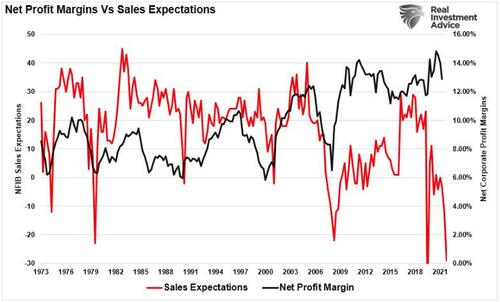

As noted, since the topline sales drive revenue and profit margins, it should be no surprise that plummeting sales expectations lead to a decline in profit margins. Such is the result of businesses discounting inventory as demand weakens.

While the above information shows a dismal outlook for our economic future, people already know these facts because they are living them. We also are seeing the consequences of the coup:

- Less supplies of staples at higher prices.

- More supplies of consumer goods that are not bought in order to “stretch” our limited money.

- Poor service as employees run the businesses instead of management.

- Poor quality as employees have no work ethic and are “quiet quitting”.

- Reduced store hours as people are giving up.

The above examples show a malignancy that may not be able to be excised: they are all historical signs of a failing empire. The Huns are at the gates and whether they are called the political elite, Democrats, the Deep State or just “the other side”, the reality of our situation is dire.

Do you ever wonder about this “other side”? I have to believe that they know they have destroyed this country and their future also. Will they be desperate enough to go scorched earth? Rhetorical questions but these people who do not want to make America great should be more concerned about whether they receive justice or vengeance for their treason.

David DeGerolamo

The Baltic Dry Index is at 1002 today. Down from over 3000 in June. That indicates that much less coal and ore is being shipped. Plus, there has been a major drop off in container ships coming to the west coast. Oil and Gasoline futures are still down. Because of a decrease in demand. And wait until winter, when the EU has no energy because they wanted to punish Russia. Collapse happens slowly, then all at once.

WTI crude oil will test 120$ at some point imo. I do not see a us stock index crash near term or even intermediate. Interest rates are inverting. last time I saw this was 3rd-4th qtr of 2019. Then corona-crash in 3/2020 happened. Perhaps it will play out similarly this time too? So 1st qtr 2023 may be interesting in the US!

Oil will probably go much higher in the long term. The G7 is going to demand a price cap on Russian oil this week. The Russians will refuse to sell to those nations. Then all bets are off. Very little oil and natural gas as winter approaches for the EU. The EU is toast. Can the ECB and NATO be far behind? The euro countries are buying Russian energy from India and China under the table at very elevated prices. But in spite of this, the EU has committed suicide.

i just had two conversations with people about how they are normalizing sloth, incompetence, scarcity, astronomical price increases and just doing without.

ordering some automotive and heavy equipment parts, they are two years out or just not anywhere in North America.

You’re just not ordering the right items. Go to any football stadium and check out the jerseys, team cups, seat cushions and other team items for sale! Plenty to go around!!! Prices don’t matter to the true fan!!!! Go Bills!