by David Stockman

The robo-machines are now having a grand old time hazing the August lows at 1870 on the S&P, and may succeed in ginning up another dead-cat bounce or two. But this market is going down for the count owing to a perfect storm.

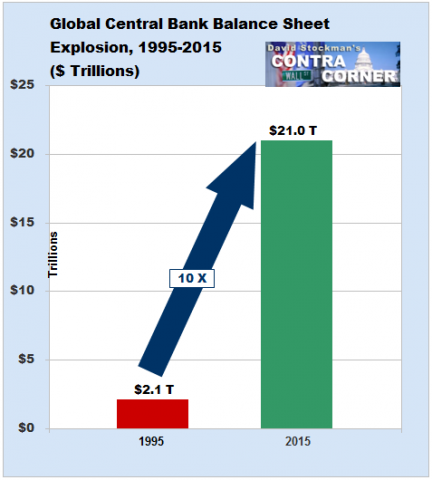

To wit, the global and US economies are heading into an extended deflationary recession; S&P earnings peaked at $106 per share more than a year ago and are already at $90, heading much lower; and the central banks of the world are out of dry powder after a 20-year binge of balance sheet expansion.

The latter is surely the most important of the three. It means there will be no printing press driven reflation of the financial markets this time around. And without more monetary juice it’s just a matter of time before a whole generation of punters and front-runners abandon the casino and head for the hills.

“And without more monetary juice it’s just a matter of time before a whole generation of punters and front-runners abandon the casino and head for the hills.”

Alas but China has already declared it will provide more “monetary juice.”

Which bring me back to a question I have been asking for years…..

How long can a country print and manipulate markets?