For many people, their patriotism is measured by their portfolio. The government realizes this and has been using POMO to artificially inflate the Dow Jones average by manipulating the value of stocks. All stocks are not doing well as shown be the recent outbreak of Hindenburg Omen days. One of the attributes of the omen are the number of stocks reaching new highs and the number of stocks reaching new lows. J.C. Penney is a good example:

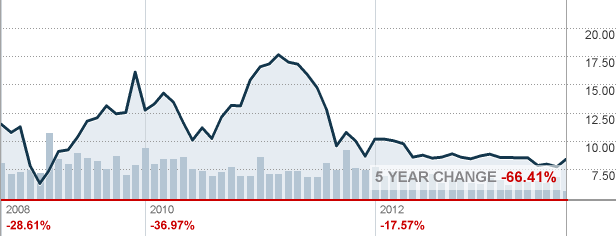

J.C. Penney (JCP)

In the past five years, this stock has lost 75.46% and its fate now seems to be in the hands of Goldman Sachs. The actual drop since 2012 is much larger as our economy declines.

Let’s look at another stock Alcoa. It is the first stock to report its earnings every quarter and is a bellwether for several sectors on Wall Street:

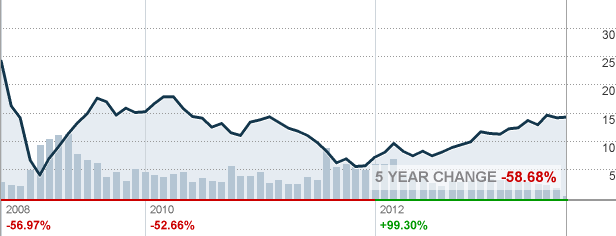

Alcoa (AA)

This stock’s decline would lead the decline of a retail stock such as Penney and the graph shows a major decline starting in early 2011. Declines in construction means declines in aluminum. Declines in manufacturing (washing machines) means declines in aluminum.

Let’s turn to the “venerable” Bank of America which is only down 58.68%. Notice the volume (POMO) to keep the bank afloat prior to 2012. Notice the volume in 2013 where the volume is low and the stock is “humming” up. People and mutual funds are not buying BAC and the price goes up? A little bit of POMO now goes a long way.

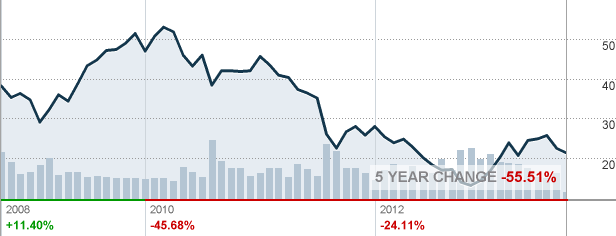

Hewlett Packard was a major company in the tech field. They bought Compaq and their large format plotters (made in Spain) are found in most engineering and architectural offices. The are also down 55.51% in the past five years. What happens when a stock is not performing well and it is part of the Dow Jones Average? It is removed and replaced by better performing stocks. HPQ and BAC have just been removed. I could have used Apple as an example but this stock is the poster child for manipulation by mutual funds and even government pension plans to be a useful example.

Hewlett Packard (HPQ)

So what stocks are doing well? General Electric is the only stock left in the Dow Jones Industrial Average from its original inception. This company makes money from the financial sector and government contracts. It has been nicknamed “Government Energy” due to its large number of government contracts. Imagine what GE’s losses would be if it paid any corporate taxes.

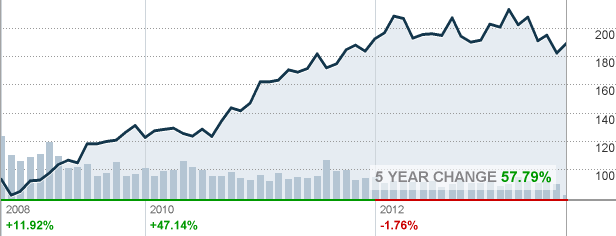

IBM is up 57.79% in the past five years and is a major component of the Dow. Removing this stock from the current run up in the Dow Jones would have a serious impact on the DJIA. Is this an anomaly or is it representing a resurgence in our economy? A large portion of this profit comes from overseas operations. In order to be successful in a world wide economy, you have to have offices and operations world wide.

IBM

General Motors (GM)

General Motors was given to the labor unions by President Bush. It also has been nicknamed “Government Motors”. This confiscation of private property by the government and redistributing it represented the end of the rule of law in America. Large government contracts have still not enabled them to repay the taxpayers for their bail-out.

Do large corporations run the government? It appears that not all large corporations are sharing equally in their favor from the Fed Reserve and the Obama administration. But those that are in favor and are in control (Goldman Sachs) represent a fusion of large corporations with the government. The correct term for this type of government is national socialism or Nazism.

David DeGerolamo