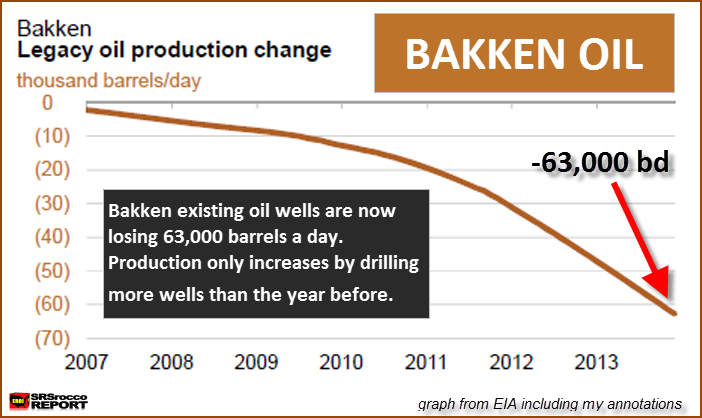

As with all oil fields, there are only so many sweet spots and areas to drill. The 63,000 bd decline rate at the Bakken only has one way to go — and that’s higher. If the present trend continues (highly likely) then we are going to see a daily decline rate of 75-85,000 barrels a day by the end of 2014.

Thus, the shale oil players are going to have to make those drilling hamsters work even harder as they will need to increase more wells each month just to grow production. At some point in time (sooner rather than later), the daily decline rate will reach a figure that these companies will be unable to offset.

There are only so many drilling locations available and once they run out, the Great Bakken Field will become a BUST as the high decline rates will push overall oil production down the very same way it came up.

Those who moved to the frigid state of North Dakota with Dollar signs in their eyes and images of sugar-plums dancing in their heads will realize firsthand the negative ramifications of all BOOM & BUST cycles. At this time, the word “Cold” will have more than one meaning.

Once the Bakken and Eagle Ford oil fields peak and decline, the United States has no other “ENERGY RABBIT” in its hat. This is precisely why investors need to understand energy and why it’s important to own physical assets such as gold and silver.

From what I read, the fracking for natural gas has similar decline rates. This energy play has more to do with real estate plays and sales of gas leases than long term production. The natural gas players acquire special treatment from the state legislators, limiting extraction taxes while burdening the existing infrastructure of the state. Their goal is short term profits, and leave the tax payer to clean up after them.