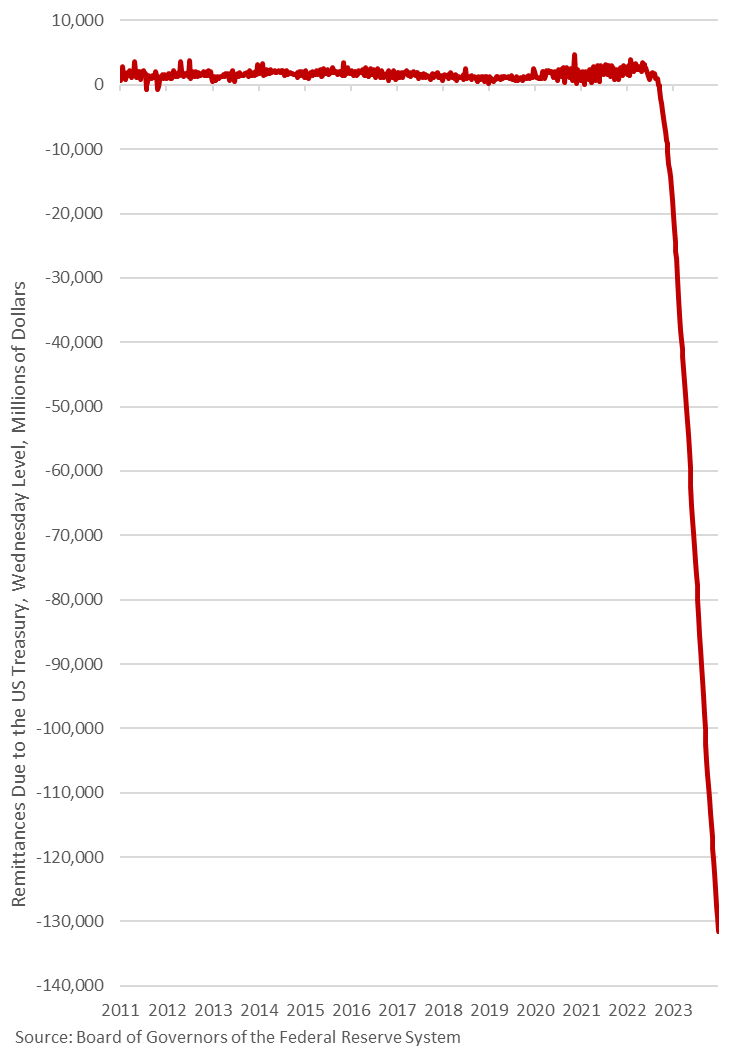

This isn’t a meme stock, some third world country’s currency, or the balance sheet of a failed regional bank – it’s the losses at the Fed, and it just exceeded $130 billion:

Actually the real losses on all securities are over $1 trillion but nobody cares since the USD is still reserve for now and will be printed to plug any holes.

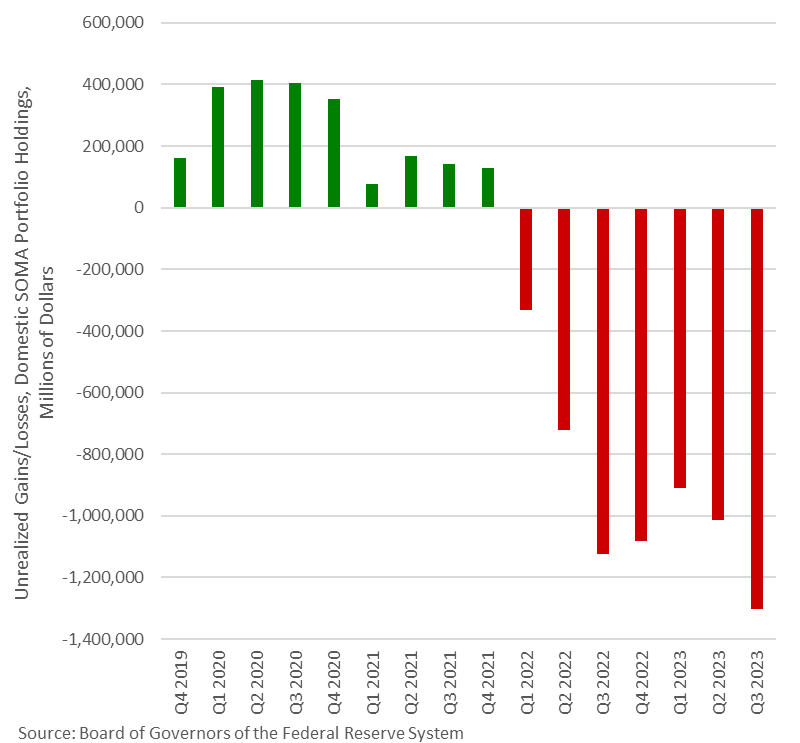

$1.3 trillion to be exact:

one day, huh, the great financial reset is underway. (and has been, since 1913)

🟧 With money funds funding the government’s general account at the Fed and therefore technically not in public circulation, we have now established one reason why broad money supply is no longer growing. Furthermore, commercial banks are thinly capitalised, and therefore some of them are at risk of insolvency under Tier 1 regulations, which strip out goodwill and other intangibles from shareholders’ capital.

Working off the FDIC’s banking statistics for the entire US banking system at end-2023 Q3, these factors reduce the entire US banking system’s true Tier 1 capital from $2,245bn to only $1,448bn, on a total balance sheet of $23,409bn., increasing notional bank leverage to over 16 times.[i]

😳Doomed

🟧 When the easy funding through T-bill issuance is exhausted, the question arises as to how a budget deficit likely to be as much as $3 trillion in total will be funded. And this estimate is before the additional welfare costs and lower tax receipts from an economy falling into recession is allowed for. It certainly won’t be by the large foreign holders of US Treasuries, who turned sellers in 2023. On the most optimistic scenario, deficit funding can only occur at higher bond yields, or by the Fed aggressively renewing its QE, or both.

The next low hanging fruit for the crazies to grab is DRUMROLL:

Your 401K, IRA, Roths and company retirement plans.

WHY? Well, it seems there is around 11.8 Trillion dollars just waiting to be “Protected” according to Vanguard.

They will use the reasoning of “Protecting the People” from the stock market gyrations. GIVE them the SECURITY of American T-Bills (or some variant thereof) to have the SAFETY and SECURITY of backed by the “Full Faith and Promises” of the American Government.

After all War Bonds did so much to support the US in WW1 and WW2, eh?

Pity is that except for rare exceptions the SAFE interest on Governmental bonds is ALWAYS Lower than Inflation.

So, your Guaranteed to lose money, over time.

Got trusted friends, trusted family and a good garden? Far better investments than money “in the Bank”.

read the Great Taking book, a little wordy, but it explains how those 401’s IRA and etc, done been took already, you just haven’t been officially notified yet.

Boring, but do read the Intro/prologue, it quantifies the author’s background. Just move past the George Soros paragraph.

Odd, I’m spending mine. Guess they will have to collect that back.

Bond value calculator: https://www.huntington.com/Personal/Calculators-Educators/bond-calculators/rate-changes-affect-value

Assume you bought a government bond at face value of $10,000, which yielded 0.8% interest per year in say year 2020. Current 10 year treasury yield is 3.8%. If you sold your bond you could get only about $7500 for it. You would “realize” or “book” the loss when you sold it. “Mark to market” accounting would force you to value the bond at the lower current value of $7500 even while you still own it. “Mark to maturity” accounting avoids this.

Same is true of mortgage loans, etc. All the banks are stuffed full of bonds which are worth less than face value, because interest rates have gone up so dramatically. The banks are all bankrupt.

By law, you don’t own your money in the bank. It will be seized to pay creditors. FDIC cannot cover the losses. Like the Great Depression, the money supply will quickly close. You will own nothing and be happy.

In the Un sanitized family histories of the Great Depression banks failed, money was lost, jobs lost AND the Tax Man and Bank Debts were *STILL* collected.

Often by bankers buying your properties for pennies on the dollar for unpaid debts GUARDED by the Sheriffs.

BLACK ROCK anybody?

Family wealth was gold in hand but remember Roosevelts EO outlawing it.

The smarter families saw the writing on the wall early and decided what properties to LET GO and made multifamily-multi-generational homes of the rest as so the income of the whole KEPT those Properties from being sized.

Multi-Families with a man or three working “REAL JOBS” that paid money had the coin of the Realm to stave off the Tax Man and Bankers. EVERYBODY worked even if the pay was a share of the firewood collected, some milk from helping at the dairy, even kids “Played” at fishing and berry picking, weeding neighbors’ gardens for veggies.

Even Grandparents earned their keep babysitting, nursing, laundry and watching out for thieves.

And you thought Granny with the shotgun was just Beverly Hillbillies, eh? Stereotypes come from Real Life(tm).

Coming SOON at a neighborhood near you.

The difference is this time they want us dead.

Yep. The slow kill vaxx isn’t fast enough for the impatient Bolsheviks.

The rob them first group wants our money first, then the Bolsheviks actions.

Or maybe we’ll end up like Mexico with Cartels running small fiefdoms and the “Official Government” a fairly limited Green Zone?

Not all plans of the DC crazies work out as planned with all those “undocumented military aged” arriving.

Time will tell but my money (LOL) is on economic collapse and Mexican Cartel zones. I’d like to be wrong as I’ve lived in a Cartel zone a few years ago. Not totally Max Max but drug runners are unstable, unlike the Italian Mob.