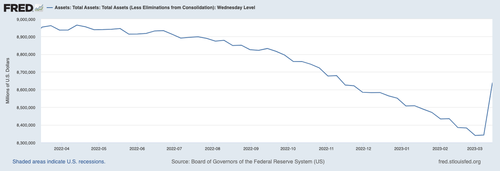

The Fed just gave out over $300 BILLION in single week.

See for yourself: the Fed’s balance sheet has erupted higher, erasing over HALF of its Quantitative Tightening (QT) efforts. Again, we are talking about $300+ BILLION in a single week.

Now, technically much of this ($164 billion to be exact) came in the form of loans to banks. The banks will have to pay this back, so it’s not quite the same as Quantitative Easing (QE). Regardless, the key point is that the Fed is NO LONGER shrinking its balance sheet… instead it is printing money. And not a little bit, but $300+ billion in a single week.

To put that into perspective, it’s the equivalent of more than TWO MONTHS’ worth the Fed’s emergency QE program that it ran in response to the pandemic. And again, the Fed did this in just FIVE DAYS.

What does this mean?

First and foremost, that something VERY BAD is going on behind the scenes in the U.S. banking system. But more importantly for us as investors, that the next round of bailouts/ easing/ reflating the financial system is here.

This won’t end well.

Sure if you go by the feds jacked up way of calculating. It’s really around 17%

Like how people were supposed to pay back the covid loans and never did.

Depends on region and type of commodity, I would say it runs from 20% to 200% on some items. Went to pick-up a packet of yellow note tablets yesterday, the price has doubled since my last purchase mid 2022. Went from $8.99 to $20.00 and change w/o the near 5% in tax.

According to the way it was calculated in 1980 it’s currently hovering around 17%.

I pray everyone is prepared because this nations time is almost up., The Good Lord is irate with the filth, lies, murders, homo Globo Slop, Thefts, and unbalanced weights and measures against righteous people.

Gotta cover those billions that the CCP had invested at Silicone Valley Bank, and all of the demoncrat cronies as well.