Form Zerohedge – If St. Louis Fed’s James Bullard is the Fed’s hawk who infamously flipped to uberdove several months ago, than Boston Fed’s Eric Rosengren has become his mirror image: a former dove who has become increasingly hawkish, and who is warning that keeping rates low for long is “not without risks.” Yet, in a speech overnight at the Shanghai Advanced Institute of Finance, Beijing, China titled “Observations on Financial Stability Concerns for Monetary Policymakers“, Rosengren voiced the same concerns about a building asset bubble as Bullard did last Friday just before Yellen’s speech, when he said that “I think we are on the high side of fairly valued, I could see the process getting away from us, maybe tech stocks, maybe others.”

Form Zerohedge – If St. Louis Fed’s James Bullard is the Fed’s hawk who infamously flipped to uberdove several months ago, than Boston Fed’s Eric Rosengren has become his mirror image: a former dove who has become increasingly hawkish, and who is warning that keeping rates low for long is “not without risks.” Yet, in a speech overnight at the Shanghai Advanced Institute of Finance, Beijing, China titled “Observations on Financial Stability Concerns for Monetary Policymakers“, Rosengren voiced the same concerns about a building asset bubble as Bullard did last Friday just before Yellen’s speech, when he said that “I think we are on the high side of fairly valued, I could see the process getting away from us, maybe tech stocks, maybe others.”

Rosengren started off cautiously with a warning that Fed’s mandated goals – stable prices and maximum sustainable employment – are likely to be achieved relatively soon, and “keeping interest rates low for a long time is not without risks.” As a result, important questions confront monetary policymakers in the United States, including when and how quickly to continue normalizing interest rates.

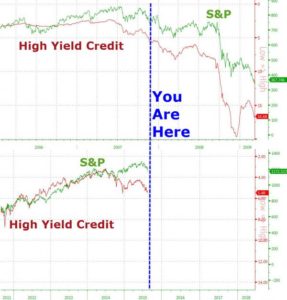

However, unlike Bullard who focused on tech stocks as indicative of bubbly forthiness, Rosengren noted that in the United States, a potential side effect of very low interest rates has been rapid price appreciation in the commercial real estate sector, adding that if the U.S. economy were to weaken, and underlying occupancy rates and rents became less favorable, a large decline in commercial real estate collateral values could lead to losses for banks. This scenario, while not his prediction, would have downstream effects on credit availability to firms and households.

Rosengren warned that “investors may be engaged in excessive risk-taking” in the commercial property sector, which if coupled with an economic shock would set off events that threaten financial stability.

RTWT – http://www.zerohedge.com/news/2016-08-31/chart-keeps-feds-rosengren-night-worries-about-bubble

~~~~~~

This is the first public acknowledgement I have yet seen, of something which I warned about back in 2011 and 2012 – specifically that there was a macro-risk from European markets which directly impacts every American Household; and further that – just considering Deutsche Bank NA – the risk of immediate contagion between the EU markets and the US economy was directly proportional to the overhang – “overhang” now being marketspeak for the over-valuation and naked downside volatility – in commercial realestate on the books of *all* major banks operating in the US, and very particularly with Deutsche Bank’s North American division (DB-NA).

“Forget the perfectly anticipated Greek (selective) default. This is the real deal. The FT just released a blockbuster that Europe’s most important and significant bank, Deutsche Bank, hid $12 billion in losses during the financial crisis, helping the bank avoid a government bail-out, according to three former bank employees who filed complaints to US regulators. US regulators, whose chief of enforcement currently was none other than the General Counsel of Deutsche Bank at the time!”

Read my whole article from December 2012 here.

And, “Consider that just 5 banks touch every American household. Three of them are primarily European banks. All are fully exposed, not only to the issues in Europe, but also to various extents in the US, China, India, Russia, the Mid-East, and South America. “Too Big To Fail” is not only alive and well in America, it has grown by over 100% since 2008! It will continue to grow until it blows…it can do nothing else. From the American perspective, it doesn’t matter where it starts – what matters is that it will all come right into our daily lives in a big way, and we have no control over it.” In that post I was speaking about RBS(Citizens Bank), HSBC, UBS, CitiGroup, and Wells Fargo. I was singling those five out, in addition to Deutsche Bank, which I had already called out by name repeatedly – here, here, here, and here are examples.

What must come of these facts is unavoidable – a systemic and global collapse of the world’s current system of trade and finance. Because “Too Big to Fail” also mean “Too Big to Fix”.

This monstrosity is presently “hidden in a closet” by those who want to maintain control of our economy and society; but the moment they believe that they can no longer manage the system by which they are stealing from us – they will ‘eject’ from the markets and retreat to the safe places they have prepared for themselves, leaving us to face the destruction and mayhem which they have knowingly created.

This becomes particularly pertinent as we approach the coming election, because the election will be a “high stress point” for those in control, and depending on how things go – both at the polls themselves, and in the wider sense of public reaction to whatever “winner” they roll out for us from behind the curtain – they may well choose to allow the collapse to occur between the election and the inauguration, if they do not get the results they want.

WE HAVE BEEN WARNED