See Tea Party Nation for additional comments.

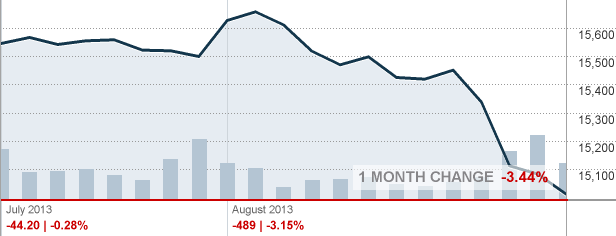

courtesy CNNFN.com

The Dow Jones Industrial Average has lost 3.44% of its “value” in the past month. The first disturbing trend is that the media is overlooking the downtown as part of a normal August cycle where the traders are vacationing in the Hamptons. I do not think Japan’s traders are on vacation and may be the partial reason why the Nikkei 225 lost more last night (August 20, 2013) than the Dow lost in the past thirty days:

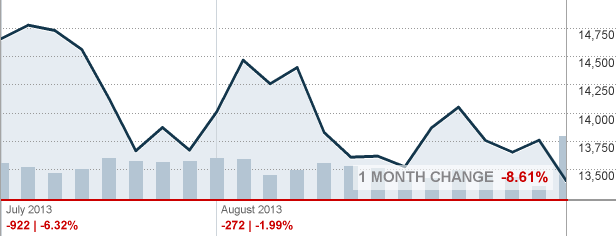

courtesy CNNFN.com

The second disturbing trend is volume of the trades represented by the bars at the bottom of the charts. As the markets collapse, the volume of trades has greatly increased as people and entities are abandoning the proverbial sinking ship. As we saw in the fall of 2008, people will be in shock when they receive their monthly retirement/stock portfolio statements in early September.

We are in the beginning of the perfect economic storm:

1. A major stock market correction.

2. Implementation of nationalized health care that is impacting wages and unemployment.

3. The beginning of the end of quantitative easing (tapering) by the Federal Reserve.

4. The US debt ceiling crisis that was breached over two months ago and it is being illegally covered up until the summer recess is over.

David DeGerolamo