By Paul Rosenberg, FreemansPerspective.com

When writing historical things, I try to include perspective from people who actually lived through the events. And for money issues in the US, I’m able to do that back to about 1905.

So, do you think life was nasty, brutish, and short in 1905? That there were poor and starving people falling dead on every street corner?

Hardly.

The Wright brothers were flying for 30 minutes at a crack; Einstein was upgrading the laws of physics; telephones and electric lights were being installed all across America; Henry Ford was getting the final pieces in place for his moving assembly line and Model T; radio was being developed; art was flourishing; and the world was more or less at peace.

Sure, we have far more tech and better medicine now, but mostly because the people of earlier times (like the 1905 era) gifted it to us.

People in 1905 lived in heated homes, refrigerated their food, had access to professional physicians, traveled the world (mostly on trains and ships), read daily newspapers (there were many more of them in those days), watched movies, and ate just about the same foods we eat.

So, was it really that bad a time?

No, it wasn’t. In fact, it was better in important ways.

The Facts Don’t Lie

Consider this:

The working person of 1905 kept his or her money. They ended up saving somewhere between a quarter and a half of everything they made – after living expenses.

It’s hard to be completely precise when reconstructing the budgets of average people in 1905 (records are hard to find), but we do have enough for a good, close guess.

Here’s how finance worked for a working family man of 1905:

Annual income: $700.00

Annual expenses: ($350.00)

————————–

Annual savings: $350.00

If you’re thinking that I’m taking liberties with these numbers, let me assure you that I’m not – I’m being conservative. For example:

- The income figure should probably be higher. I’ve found figures of well over $800 for construction workers.

- As for expenses, I rounded up from a New York Times article, dated 29 September, 1907. It specified $325 per year.

- Added to that is the fact that many people grew their own food during that time, which would skew the figures further.

- As noted initially, I compared these numbers with stories I heard from relatives who lived through the time. My uncle Dave, for example, used to tell me how he got a job paying $390 per year sweeping floors as an unskilled immigrant (who spoke almost no English) in 1903.

The next time you drive through an old part of town and see the grand old houses, remember that people were able to build and buy them because their paychecks weren’t stripped bare. There were no income taxes in 1905, no sales taxes, no state taxes, and not much in the way of property taxes.

There was also no such thing as a military-industrial complex in those days, and – miracle of miracles – the rest of the world survived!

And Now…

Today, the situation is much, much different. The average working family pays about half their income in combined taxes: income taxes (to the state and the Feds), payroll taxes, property taxes, gas taxes, utility bill taxes, sales tax, local taxes, and on and on.

So, figuring an average income of just over $50,000 (the 2011 figure). And combined taxes of about $25,000, the average American family is left to pay bills like these:

Mortgage 11,000

Car payments 6,000

Gas, repairs, etc. 2,500

Property taxes 2,500

Food 3,000

————————–

Total: $25,000

That leaves people zeroed-out. And again, I’m being conservative, and I haven’t included a number of smaller expenses.

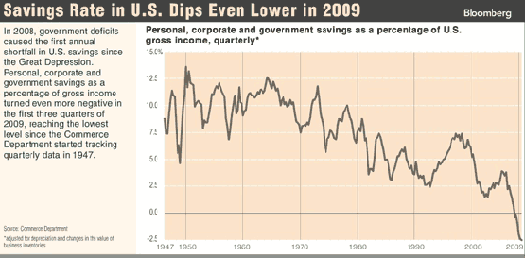

And if you think I’m going overboard, look at this graph of the savings rate from between 1947 (as far back as I could find) and 2009. This graph covers more than families, but it paints a clear enough picture:

Great Grandpa Did It, So Why Not Us?

Your great grandfathers faced very few of the taxes that we face. (The government survived on tariffs.) There was no social security either, and – believe it or not – the streets were never full of starving old people. Families were able to take care of their own – it’s not that hard when you’re saving half of your income!

We have forgotten that it was once possible for an average person to accumulate money. The truth is that productive people should be comfortable. Well-off, as they used to say.

So, why can’t we party like it’s 1905?

You might want to think about that question. Here’s a thought that may be useful:

You can complain about abusers all you like, but the people who obey the abusers are also to blame.

[Editor’s Note: Paul Rosenberg is the “outside the Matrix” author of FreemansPerspective.com, a site dedicated to economic freedom, personal independence and privacy. He is also the author of The Great Calendar, a report that breaks down our complex world into an easy-to-understand model. Click here to get your free copy.]

So, cost of living in relation to gross income has not changed much based on percentages. The amount of money that goes to taxes has increased to consume all the remainder.

This also doesn’t take into account the percentage of the cost of goods that make up the cost of living numbers that goes to pay the taxes on the producer, distributor and transportation. These hidden (from the end user) taxes account for a significant percentage of the costs of goods and services, in some case easily as much as 50% of the cost goes to pay taxes upstream.

If taxes were 50% of what they are today, you could see as much as 30-40% of your gross income become surplus to your daily expenses vs current 0 surplus.