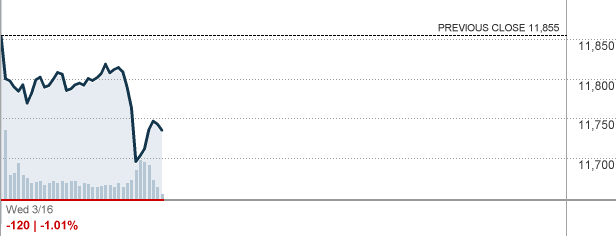

I wrote an article last November concerning the manipulation of the stock market by the Federal Reserve (see complete article below). This policy is clearly shown today in a snapshot from CNNMoney.com. The bars represent the volume of shares sold. As noted in my first article, the large spike in sales at the opening bell represents people selling off their stocks. The chart below clearly shows the market collapsing over 120 points in a few minutes later in the morning. The selloff is reversed by the Federal Reserve artificially propping up the market.

Remember the bank commercial asking “What’s in Your Wallet”? Ask yourself “Who’s in My Portfolio and Retirement Account? We know who is in the union worker’s pensions.

David DeGerolamo

Original Article from November 30th, 2010

Don’t Ask, Don’t Tell – POMO

The New York branch of the federal reserve bank is manipulating our stock market on a daily basis with a system named Permanent Open Market Operations (POMO). US stocks are sold around the clock in markets across the world. In the past month, our stocks have had down turns before trading starts in New York at 9:30 AM. In order to avoid a stock market run or crash, the Fed has been buying stock in order to shore up the market. Today (November 30th, 2010), the Fed put in $6.8 billion in monetized capital which devalues our dollar. The graph from money.cnn.com below shows today’s market history.

The plunge at the open represents the sell off of US stocks in Asia and Europe prior to the opening bell. You can easily see when the Fed steps into the market to buy stock with dollars created out of the ether. The goal is only to maintain the market’s value. Whenever the index starts to decline, POMO steps in to maintain everyone’s portfolio. That is assuming that you have a portfolio. The problem is that your IRAs and 401Ks are being kept at an artificial level using money that does not exist. Not only will the market crash when this policy is stopped or when it is exposed in the official media, the American public will lose twice. The first loss is the loss of the actual value of the stocks and the second is the loss of the dollar’s value because of POMO.

The month of November saw just under $50 billion printed to maintain the market. This is in addition to the $600 – 850 billion for Quantitative Easing II. Our saving grace is that the rest of the world is supporting the US dollar as they run from the Euro and the possibility of a war in Korea. As written in another article, this is another incorrect strategy as the IMF bailout of Ireland will have the United States contributing more than any other country further devaluating our dollar.

The New York Federal Reserve Bank prints a detailed account of POMO activity. The following is their explanation of POMO:

The purchase or sale of Treasury securities on an outright basis adds or drains reserves available in the banking system. Such transactions are arranged on a routine basis to offset other changes in the Federal Reserve’s balance sheet in conjunction with efforts to maintain conditions in the market for reserves consistent with the federal funds target rate set by the Federal Open Market Committee (FOMC).

This would be an excellent topic for the new Congress to address in January.

David DeGerolamo

[…] Federal Reserve’s POMO policy to shore up the stock market is working well today as seen below from […]