Earlier today, David shared his observations on the expansion of the M1 money supply. This afternoon I checked the “spot” price of gold. Oh look, movement “up” …

Not surprising when an expanding suppy of “exchange media” chases a scarce commodity.

Then again, not surprising when we have experienced the systematic and intentional destruction of our monetary system for the last 100 years.

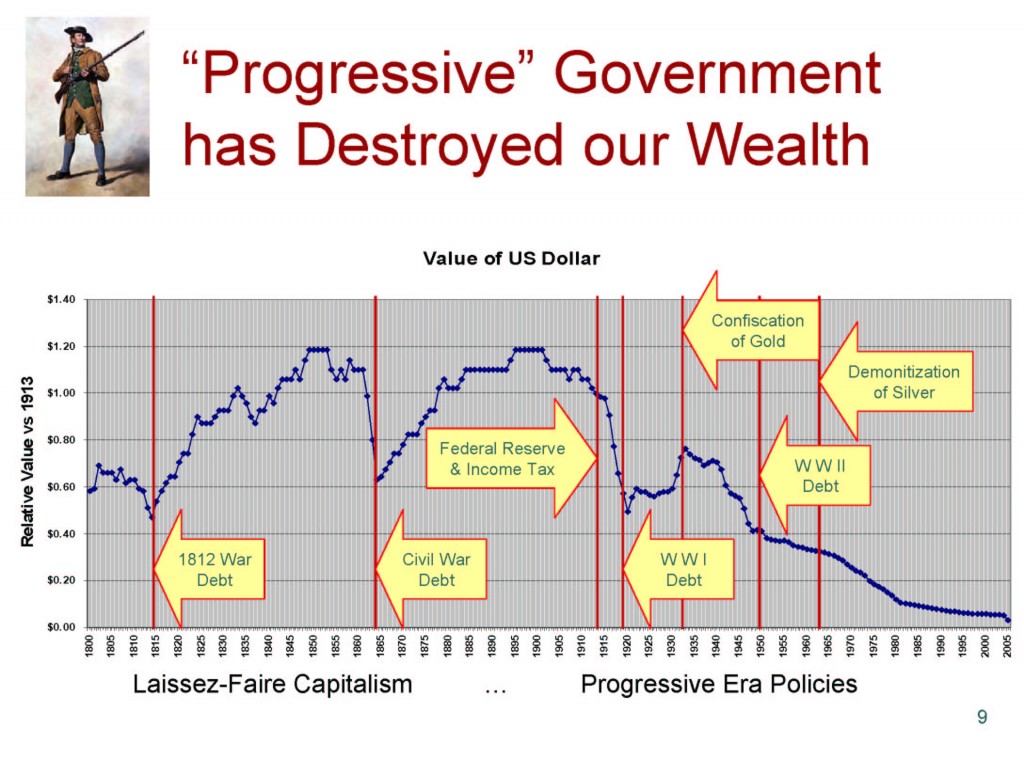

I built the following slide for a presentation I delivered last summer.

Lesson from the chart:

Specie based money is a storehouse of value

Fiat money (legal tender) is a government engine of wealth destruction (theft)

In the 19th century:

War debt was the primary driver of lost value (purchasing power)

Value recovered in a predictable fashion in each period following war, as the debt was paid down

In the 20th century:

During the “roaring twenties” monetary policy prevented the recovery of value after WW I

A deflationary recovery of value had begun after the crash of 1929 but was killed by price controls

Demonetization of precious metals resulted in an institutional theft of wealth

Our currency never recovered as a result of financial policies after WWII

Both Parties contributed to the destruction of our wealth

… it almost doesn’t matter except to point out the hypocrisy of the Republicans

When there is more “paper” in circulation, each unit is worth less … WORTHLESS !

Take the raw data and conduct your own analysis in context of history.

Learn … understand … prepare to act.

Today’s movement in gold was due to world buying, not the devaluation of the dollar. Follow the money (M1 Money Supply) to see what the devaluation of the USD will bring in the very near future.

Hi David

I understand yesterday’s (and today’s $1460+) upward movement in the price of gold has many drivers.

$1460 per ounce. The historic value of the dollar was 1/20 of an ounce ($20 / oz) before FDR confiscated gold and reset the exchange at $35 / oz.

My post in response to your story on the expansion of M1 was intended only to illustrate the “presence of malice” in the Progressive agenda.

My point also. I was surprised at the large increase due to world buying. When the dollar collapses, the price of gold will hit $2000 in a short period of time (months). Buy gold not to make money but to preserve it.

Your point concerning the price of gold prior to FDR is usually told in reference to a man’s suit. Both $20 in dollars or gold bought a suit. A well made suit today costs about $600 (for me). That same amount of gold would buy 2-1/2 suits today.