CADD Graphics

Carolina Readiness Supply

Websites

NC Renegade on Twitter

NC Renegade on Gab

NC Renegade on Truth Social

Wes Rhinier on Gab

12 Round Blog

Barnhardt

Cold Fury

DanMorgan76

Defensive Training Group

The Deth Guild

The Feral Irishman

First in Freedom Daily

Forloveofgodandcountry's Blog

Free North Carolina

Knuckledraggin My Life Away

Liberty's Torch

90 Miles From Tyranny

Professor Preponomics

Publius-Huldah's Blog

Straight Line Logic

The Tactical Hermit

War on Guns

Western Rifle Shooters Association

Categories

-

Recent Posts

Recent Comments

- Matt x on All Good Things

- Priscilla King on Should Erika Kirk Forgive Her Husband’s Killer?

- Priscilla King on Should Erika Kirk Forgive Her Husband’s Killer?

- GenEarly on All Good Things

- David on No Mercy: Woke Leftists Are The Problem And They Need To Go

Archives

Meta

State collapse is inevitable when a society's leaders are insulated from the negative consequences of their bad decisions. Mike Shelby

Deficits don’t matter, Dick Cheney.

Well, if we’re quote dropping, here’s one I like:

“Dick Cheney doesn’t matter. Nor does his two faced whore spawn of a daughter.” – Big Ruckus D

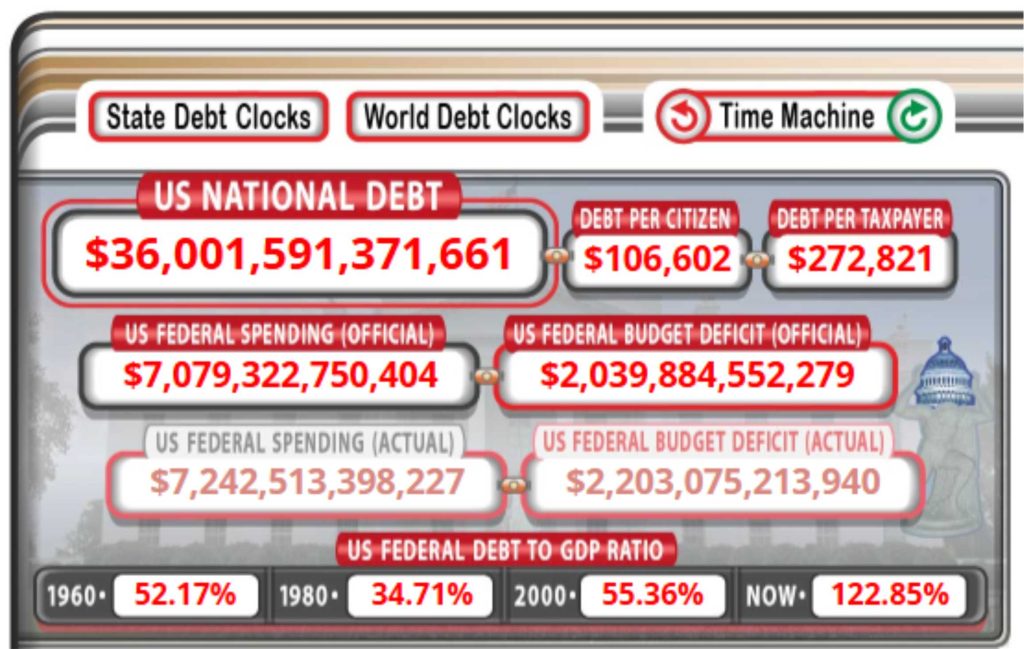

Meanwhile, the figures in the posted graphic perfectly summarizes why, irrespective of any political progress Trump may make (and which remains to be seen), we’re screwed. There is no way that level of debt (along with ongoing deficit spending, which shows no sign of abating even under Trump) isn’t going to wreck the FUSA.

One TRILLION. What does it mean? Our FedGov doesn’t know or GAF.

For example, one trillion seconds = 31,709 years. Yes, years.

This reeks of Ponzi. I do not believe–for, er, even one second, that this level of debt will ever be repaid–or is even intended to be repaid. Instead, some form of debt forgiveness/nullification/reset will occur; this will forgive the banksters ( including the (((Fed)) ) and small debtors like all of the rest of us.

But the effects of this forgiveness will be felt disproportionately by we, the people. The Rothschilds, Yellens, Goldman Sachs types will skate, reorganize and demand to be given the keys to World Finance once again, regardless of the fact that they were the curators of this fustercluck and deserve hot lead instead.

They will say, “Oh, we are the only ones with the expertise to be able to manage large financial vehicles, etc., etc. etc.”

Again, hot lead would be the appropriate response.

My advice (expert that I am): Tangible assets.

And be quick about it. Tick tock…….

“The Rothschilds, Yellens, Goldman Sachs types will skate,…”

Well, here’s one more soul starting to notice.

HardLook,

“Level of debt” ? To whom may I ask ? How does one “owe” “money” to one who has no “money” to give ?

This “debt”; this “federal deficit” Is a load of crap. What item of value backs the paper money one has stuffed under their mattress for a rainy day ? More than 50 years ago “Tricky Dick” Nixon took this FUSA off the gold standard. Our Federal Reserve notes have no true value.

The borrowed “money” from the Federal Reserve is the biggest scam, largest lie perpetrated on the American citizen. What if the Fed Reserve had no ink ?

All true. But we “owe money” because they say we do.

And what say do we have?

HardLook “….because they say we do.” Exactly.

And add in a currency crash. Even Trump is pushing Bitcoin. Huge changes coming. Hard times.Very soon.

Can someone explain to me where the Federal Reserve gets the “money” to “loan” to the FUSA government ?

BINGO!

The gig is up. No denying. No red white and blue can fix this. They are all guilty. Every administration fleeced us.

Yep…One Trillion every 86 days! Did you see this from Turner: Setting-Up a “Crash?” Federal Reserve PULLS more than HALF of Credit Available through Bank Term Funding Program (BTFP)

Remember when it was a mere $1T in 100 days? Now it’s 86 days. And being that it’s an exponential function, the amount spent will continue to increase, while the time window needed will decrease. Pretty soon it’ll be $2T every 100 days. And that will be the trend until something forces and end to the practice. My advice is to expect some exogenous event to do exactly that.

spending more than we take in……..nothing to see here, keep moving. Just remember, FDIC and FSLIC haven’t even a dollar to cover each “insured” account

Setting-Up a ‘Crash?’ Federal Reserve PULLS more than HALF of Credit Available through Bank Term Funding Program ) POWELL IS PULLING LIQUIDITY TO TRIGGER A CRISIS JUST LIKE 2020, ALSO THE $36T DEBT CEILING WILL HIT TOMORROW { Also the debt ceiling is closer to $39.3 Trillion now, they are always slow at putting out the real numbers !!!!! }

https://henrymakow.com/2024/11/nov-15—sleepwalking-to-the-a.html

“Debt Ceiling!” Oxymoron, that. The “ceiling” is actually a “Debt Elevator” and, when the correct buttons are pushed, miraculously rises to somehow remain above the floor.

So as to not crush the occupants of said “Debt Elevator.”

As Matt Bracken has written, one possible scenario to ignite the entire mess could be the disruption of EBT cards for the Great Unwashed, who will not go quietly into the night when their food costs are handed back to them:

https://theprepperjournal.com/2013/09/05/music-stops-americas-cities-may-explode-violence/#google_vignette

Excerpt:

“It’s estimated that the average American home has less than two weeks of food on hand. In poor minority areas, it may be much less. What if a cascading economic crisis, even a temporary one, leads to millions of EBT (electronic benefit transfer) cards flashing nothing but ERROR? This could also be the result of deliberate sabotage by hackers, or other technical system failures. Alternatively, the government might pump endless digits into the cards in a hopeless attempt to outpace future hyperinflation. The government can order the supermarkets to honor the cards, and it can even set price controls, but history’s verdict is clear: If suppliers are paid only with worthless scrip or blinking digits, the food will stop.”

A bridge is being built right before our eyes by deregulating banks and deregulating crypto. (which will give more power to the banks) Musk shrinking government departments is helping the banks bring in digital $

Says GM