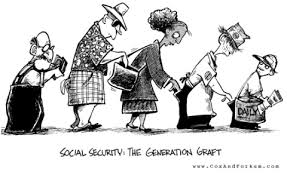

The trend in Social Security reform should be a concern of every American. The trend is to make the system bigger, with a wider revenue base by pushing the cost of the system from the covered worker to the general taxpayer. It is an enormous increase in the revenue reach of the system.

The trend in Social Security reform should be a concern of every American. The trend is to make the system bigger, with a wider revenue base by pushing the cost of the system from the covered worker to the general taxpayer. It is an enormous increase in the revenue reach of the system.

It is important to understand how this change in funding increases the revenue base of the system. Payroll taxes which fund Social Security can draw up to 15.3% of wages, up to a cap. So the sole funding source for Social Security is capped-wages. When funding for Social Security comes from the general fund, it can draw on all of the taxpayer’s income, including interest, dividends, capital gains, rents, royalties, casino winnings and the like.

This trend was first predicted by A. J. Altmeyer who was the Chairman of the Social Security Board in 1944. He warned Congress at that time; “It is a mathematical certainty that the longer the present pay-roll tax rate remains in effect, the higher the future pay-roll tax must be if the insurance system continues to be financed wholly by payroll taxes. “ He continued to say that “(Underfunding Social Security) creates a moral obligation on the part of Congress to provide a Government subsidy later on to the extent necessary to avoid levying inequitably high pay-roll tax rates in the future.” In short, if you do not raise these taxes, the payroll taxes will rise in the future to levels that cannot be sustained.

We reached that point in the mid-1970s. Congress developed the Earned Income Tax Credit to reimburse low-wage workers for contributing to Social Security. According to Bill Clinton: “The EITC, which dates back to 1975, was originally designed to offset the burden of the Social Security payroll tax for low-wage workers with children.” Congress has now created the payroll tax-holiday because the middle class cannot afford payroll tax rates.