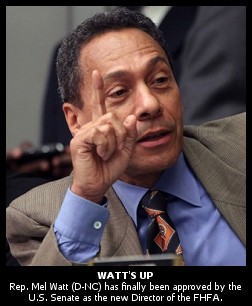

FHFA Director Mel Watt said last month that Fannie and Freddie would soon begin to guarantee loans with down payments as low as 3 percent, though the final details of that plan have yet to be released. The two companies operate by buying loans from lenders, selling those loans in mortgage-backed securities, and then guaranteeing payment to investors if the loans default.

Fannie and Freddie purchased loans with little or no down payments before 2008, but had largely stopped doing so in recent years.

Watt also expressed concerns that lenders had restricted loans to borrowers with lower incomes or credit scores out of concern that Fannie and Freddie would force them to buy back the loans if they defaulted. He outlined instances where lenders would not have to repurchase the loans, and encouraged them to loosen up lending standards.

…

“There are creditworthy borrowers in today’s market who have the income to afford monthly mortgage payments but do not have the money to make a large down payment and pay closing costs,” [Watt] said in prepared remarks at the National Association of Realtors Conference & Expo. “Purchase guidelines that allow for 3 percent down payments will provide an opportunity for access to credit for some of these borrowers.”

Don’t think there will be many bankers, even as non-risk-averse as they have shown themselves to be in the past, that will be tempted to go for this again.

dumb and mentally ill black man, we have to get this guy out of the congress at the next election.