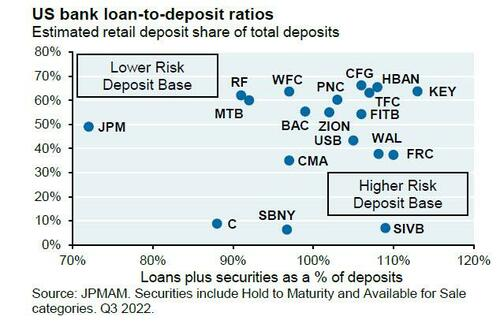

So we are really down to which banks have the most bank run risk, which as we explained, are primarily America’s small, regional banks.

How are they holding up today? Well, not good: here is the KRE index…

$KRE down 30% in past week, a rare short-term plunge for something so diversified. pic.twitter.com/9zUWJzODYR— Eric Balchunas (@EricBalchunas) March 13, 2023

… while its consttiuent members are having a very bad day as the following headlines reveal:

- *FIRST REPUBLIC BANK HALTED FOR VOLATILITY, DOWN 65%

- *PACWEST HALTED FOR VOLATILITY; DROPPED 41% TO LOWEST ON RECORD

- *REGIONS HALTED FOR VOLATILITY AFTER PARING 31% DROP TO 20%

- *WESTERN ALLIANCE SINKS A RECORD 76%; HALTED FOR VOLATILITY

These are the things that tend to cause heartburn. I split my money across two banks hoping that if one goes down, I can get to the money in the other. Seeing one of my banks in this list does not make me happy. These are the reasons we prep.