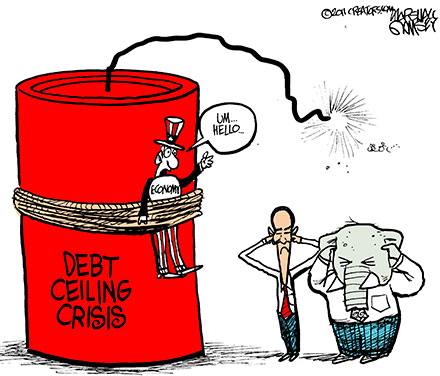

The debt ceiling deadline is August 2nd. The House of Representatives sent Cut, Cap and Balance legislation to the Senate and left Washington. The Senate did not approve the House bill, Harry Reid said it was now up to the House to solve the crisis and dismissed the Senate. The president has no plan or desire to solve this crisis.

The debt ceiling deadline is August 2nd. The House of Representatives sent Cut, Cap and Balance legislation to the Senate and left Washington. The Senate did not approve the House bill, Harry Reid said it was now up to the House to solve the crisis and dismissed the Senate. The president has no plan or desire to solve this crisis.

And make no mistake: the crisis is upon us. The best case scenario would be for a compromise to be worked out over the weekend and presented to Congress on Monday. Congress then would have to debate and ratify the legislation in both the House and the Senate. Once approved, the two versions would then have to be resolved together and approved. Then the president has to sign it.

The problem before us was outlined by Tim Geithner: the legislation needed to be submitted last week in order to be approved by August 2nd. There is no time left to avoid a default by the deadline. What is Mr. Geithner saying now? Nothing. What is Ben Bernanke saying now? Nothing. What is Standard & Poor’s saying?

Standard & Poor’s educates House GOP on debt limit

Forty members of the House Republican caucus were told of the dire consequences for the economy if the U.S. fails to raise it debt limit in August by the leading credit agency Standard & Poor’s.

David Beers global head of sovereign debt at S&P reiterated what S&P has said publicly, that both a failure to raise the debt ceiling and a failure to tackle the long term fiscal challenges of the U.S. risk a downgrade of the U.S. AAA rating.

S&P, members said, emphasized that a default would cause a spike in interest rates that would “cascade” through the economy.

Members emerged from the meeting convinced both of the seriousness of avoiding a default and saying that S&P had reaffirmed their belief that the debt ceiling should not be raised without a credible plan, such as the GOP’s Cut, Cap and Balance, to deal with the debt.

Egan-Jones Credit Rating Service has already downgraded our rating to AA+. One of the consequences of a lowered credit rating means that the United States will have to pay a higher rate of interest on our debt. How much higher is unknown since lowering our credit rating will show the world that our economy is collapsing. For every 1% increase on our national debt of $14.3 trillion, we have to pay $143 billion a year on interest as our debt is refinanced. That is not including the other $114.7 trillion owed for Social Security, Medicare, Medicaid and Prescription Drug programs.

The consequences of not holding our government responsible for the past 100 years are now here. The irony is that the American people still do not understand what is happening.

David DeGerolamo