(Zerohedge) 29 September 2016 – Deutsche Bank concerns just went to ’11’ as Bloomberg reports a number of funds that clear derivatives trades with Deutsche Bank AG have withdrawn some excess cash and positions held at the lender, a sign of counterparties’ mounting concerns about doing business with Europe’s largest investment bank.

While the vast majority of Deutsche Bank’s more than 200 derivatives-clearing clients have made no changes, some funds that use the bank’s prime brokerage service have moved part of their listed derivatives holdings to other firms this week, according to an internal bank document seen by Bloomberg News.

~~~~~~

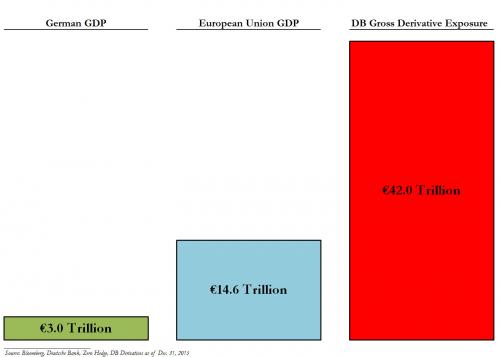

Every Bank in the World, including every Central Bank, is a Couter-Party to Deutsche Bank’s massive risk overhang, so it’s very easy to see how quickly DB can bring down the entire global banking system. Because Deutsche Bank’s Derrivitive Portfolio alone is **THAT** large. And this doesn’t even take into account all the commercial and residential real-estate across Europe and North America in their portfolio, which Deutsche has never marked to market value since the 2008 sub-prime crisis. Their over-valuation on real estate alone is likely on the order of another 8 to 10 Trillion Euros of “lost value” which DB has yet to take the hit on.

Can you say, “Fire Sale, boys and girls?”

Because that’s what it will be, when Deutsche Bank starts selling assets like mad to cover their liabilities.

Deutsche’s direct derivative exposure is 42 Trillion Euros in size, which is nearly $50 Trillion Dollars which is nearly equal to the GNP of the entire world.

As such, there is no currency, no country, no corner of the world where the collapse of Deutsche Bank will not be felt…painfully.

Any Questions?

WE HAVE BEEN WARNED