Moreoday, three seconds before the close, someone was in a desperate hurry to dump 60,000 E-Mini contracts – the equivalent of $4.1 billion in underlying notional (ignoring the reflexive impact on various correlated assets and downstream synthetic instruments like ETFs and options). What happened next was a trade that was just shy of the size of the Waddell and Reed trade that the SEC said caused the flash crash. Luckily this time there was just 3 seconds of potential waterfall after-effects before the market closed. Had this happened at the May 6 blue light special time of 2:30 pm, the month end marks of US hedge funds and prop desks would have looked very different one day before the all too critical FOMC statement. The question remains: who waited to perform a reverse E-bay (inverse bid all in, in the last second of trading), and just what do/did they know? Below we present the complete 60,000 dump in its full visual glory courtesy of Nanex. But hold on. There is a twist…

From Nanex: eMini Wipe-out

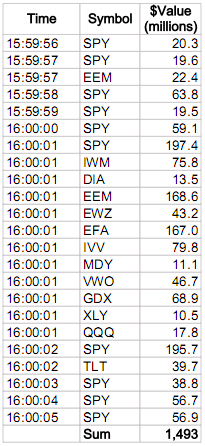

On July 31, 2012, starting about 3 seconds before the close (15:59:57 EDT), our monitoring software alerted us to an unusually large trade of over 60,000 eMini (ES September 2012) contracts that were sold at once. At the same time, we also received an alert showing large and unusual trades in ETFs (note the last column is the value of the trade in millions of dollars):

|

* Equity Markets crash and burn, under cover of headlines about war and inflation, most citizens will lose their life savings in market and bank collapses – early August

https://ncrenegade.com//editorial/for-your-pre-war-consideration-a-peek-into-the-twilight-zone/