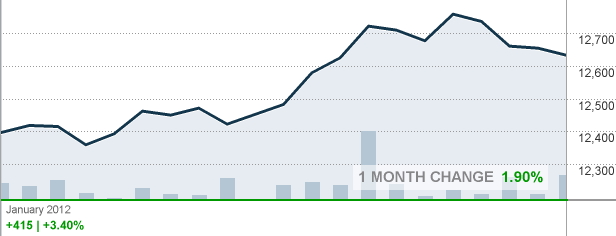

The New York Stock Exchange rose 415 points (3.4%) in January. But who is buying stocks? The bulk of the trades (30-50%) are made at the end of the trading sessions. Ever wonder if anyone is actually looking out for the individual when buying stocks/bonds/mutual funds for 401K plans? The key is not the increase in the stock market: the key is the volume. As shown below from a Zerohedge.com article, the volume of trades in the stock market is off 59% since 2008.

So why is the market going up if no one is buying stock? And why did the gold ETF (GLD) outperform the market three fold in January if the economy is recovering along with unemployment?

David DeGerolamo

January 2012 NYSE Increase: +415 (3.4%) – CNNFN.com

January 2012 GLD Increase: +17.12 (11.4%) – CNNFN.com

Dead Market Exhibit A: January Volume

Presented with little comment except to say that the total lack of volume (and massive concentration of what volume there is at the close) is hardly reflective of a market that is anything other than broken and dying. Last January (2011) the average number of stocks traded on the NYSE per day was 891mm shares vs 661mm for this January (a 26% drop YoY!) and this is down an incredible 59% from January 2008.

AND WHO, HOW AND WHEN WILL THE ‘RUG’ BE PULLED OUT FROM UNDER????