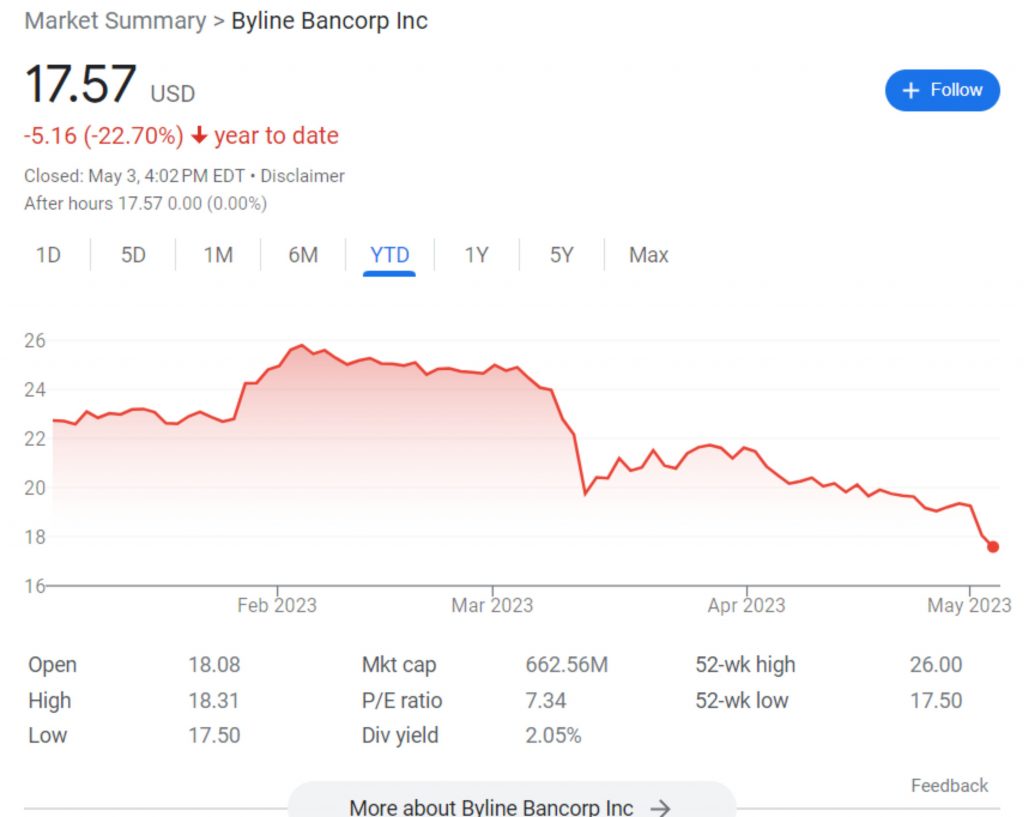

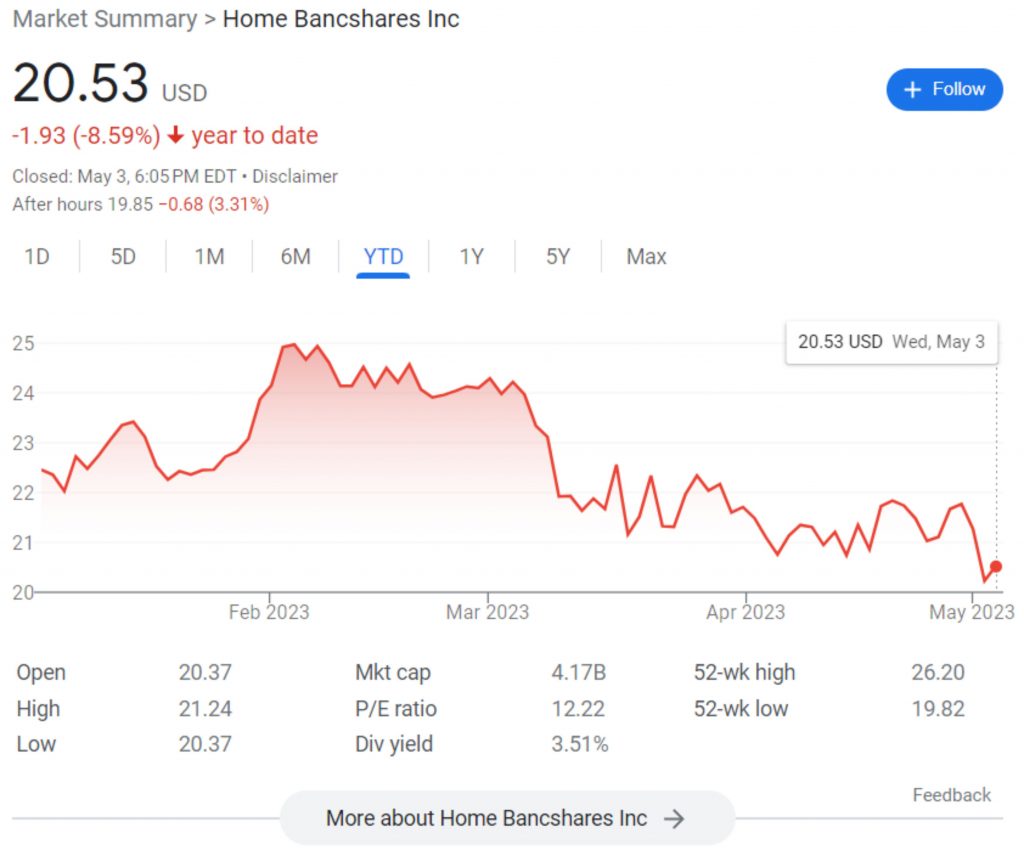

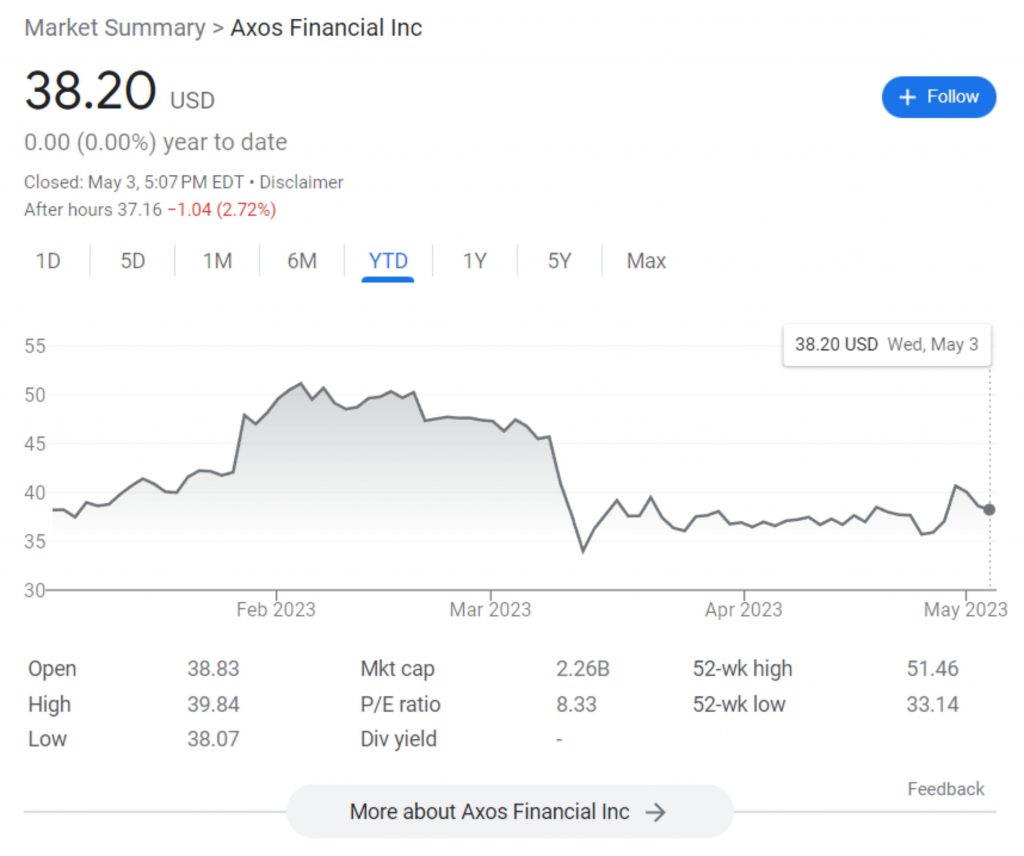

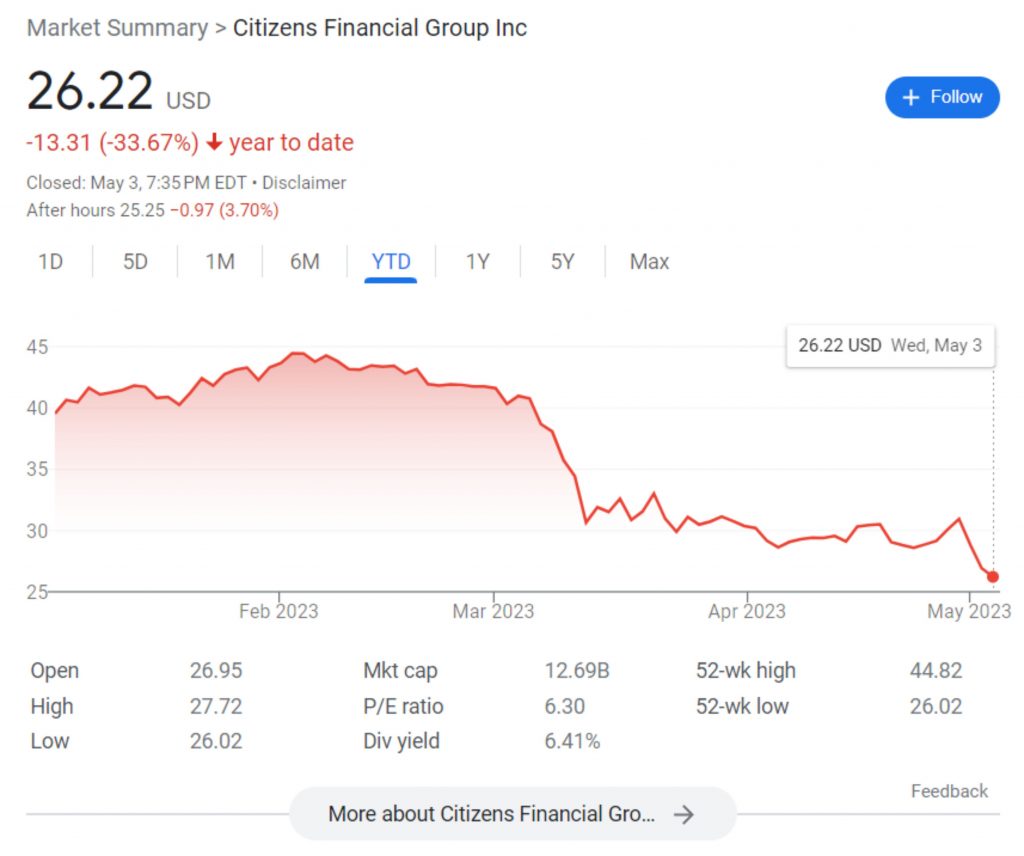

This is a list of top ten regional banks in the country ranked by SA Quant ratings. I generated graphs of each bank’s stock year to date as of today.

No. 10: Byline Bancorp, Inc. (BY): SA Quant rating 2.88 and Wall Street analyst rating 3.83.

No. 9: Home Bancshares, Inc. (HOMB): SA Quant rating 2.88 and Wall Street analyst rating 4.00.

No. 8: Citizens Financial Group (NYSE:CFG): SA Quant rating 2.91 and Wall Street analyst rating 3.95.

No. 7: OFG Bancorp (OFG): SA Quant rating 2.98 and Wall Street analyst rating 4.50.

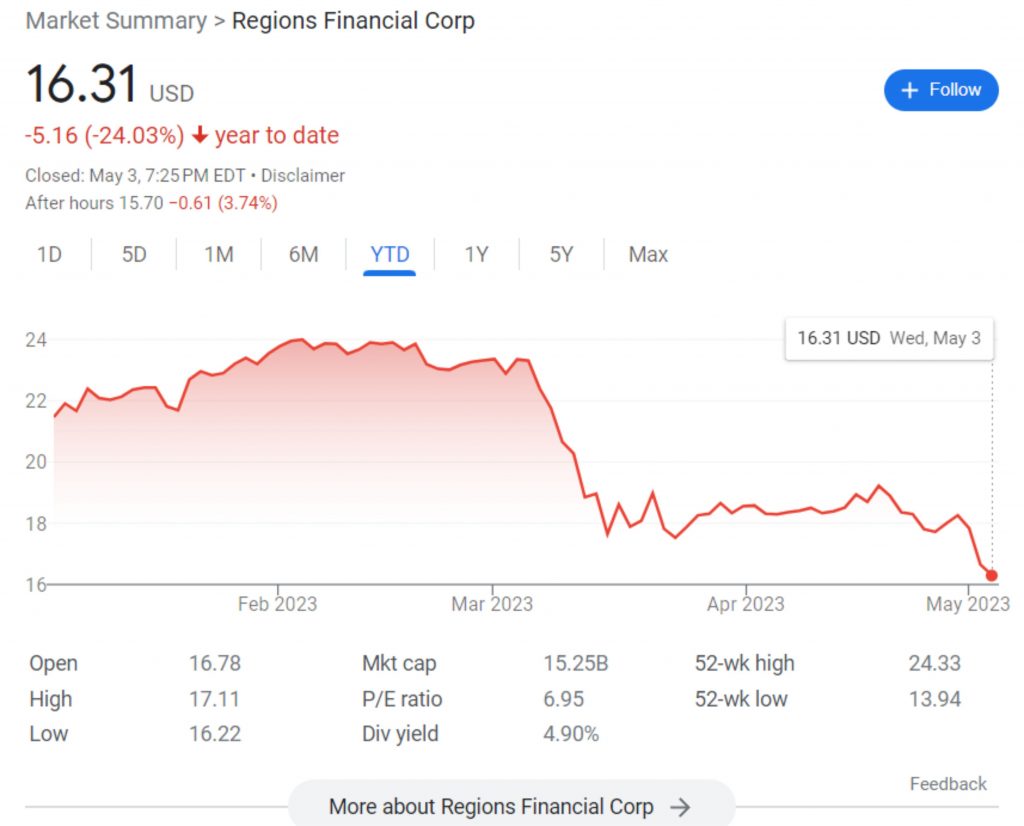

No. 6: Regions Financial Corporation (NYSE:RF): SA Quant rating 3.00 and Wall Street analyst rating 3.85.

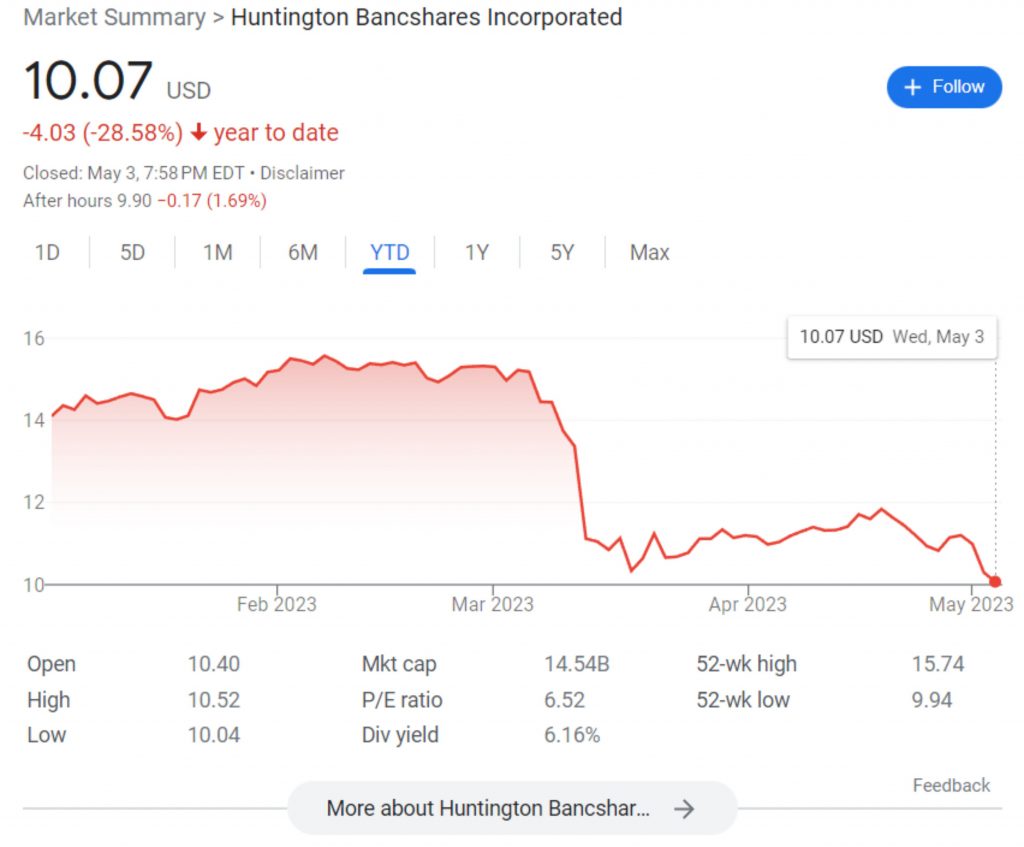

No. 5: Huntington Bancshares Incorporated (HBAN): SA Quant rating 3.02 and Wall Street analyst rating 3.30.

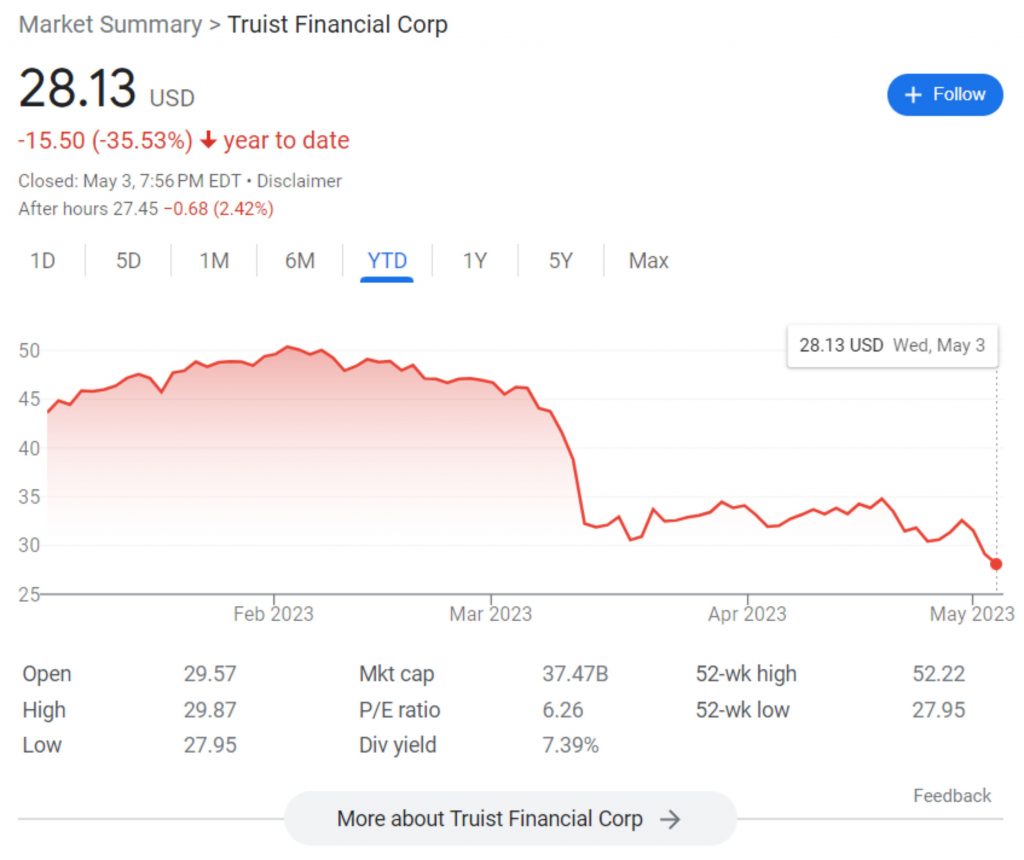

No. 4: Truist Financial Corporation (NYSE:TFC): SA Quant rating 3.08 and Wall Street analyst rating 3.70.

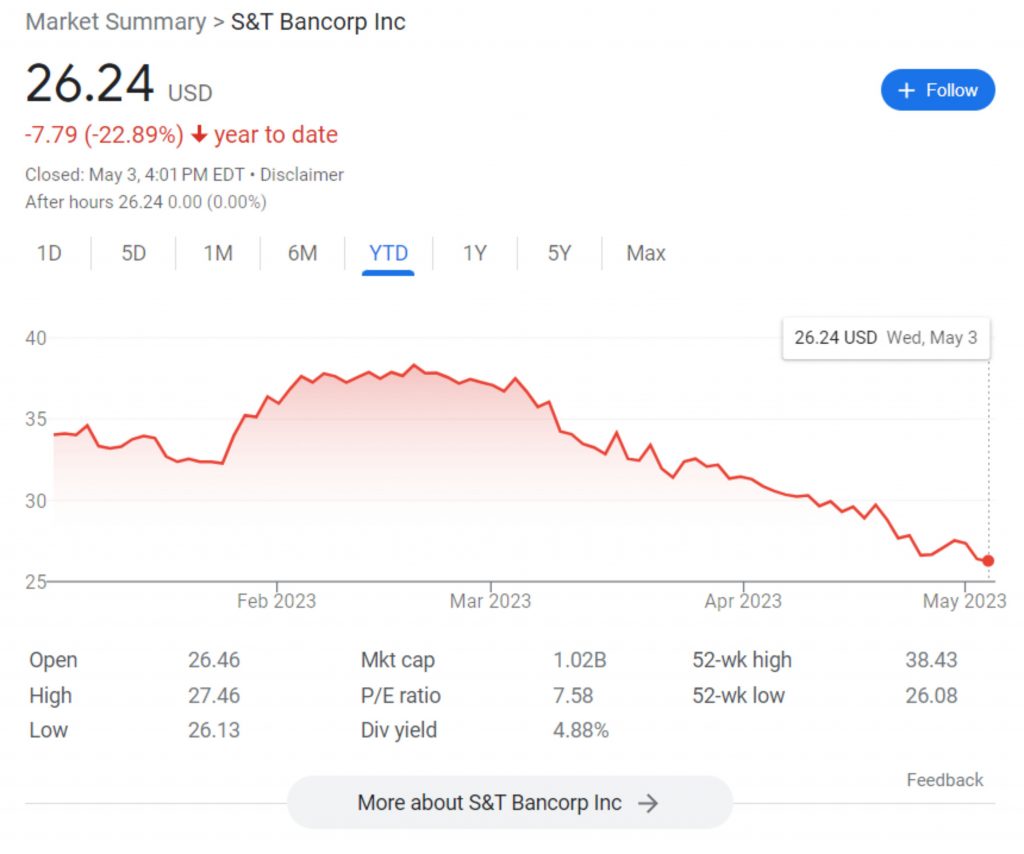

No. 3: S&T Bancorp, Inc. (STBA): SA Quant rating 3.74 and Wall Street analyst rating 3.00.

No. 2: Axos Financial (AX): SA Quant rating 4.47 and Wall Street analyst rating 4.16.

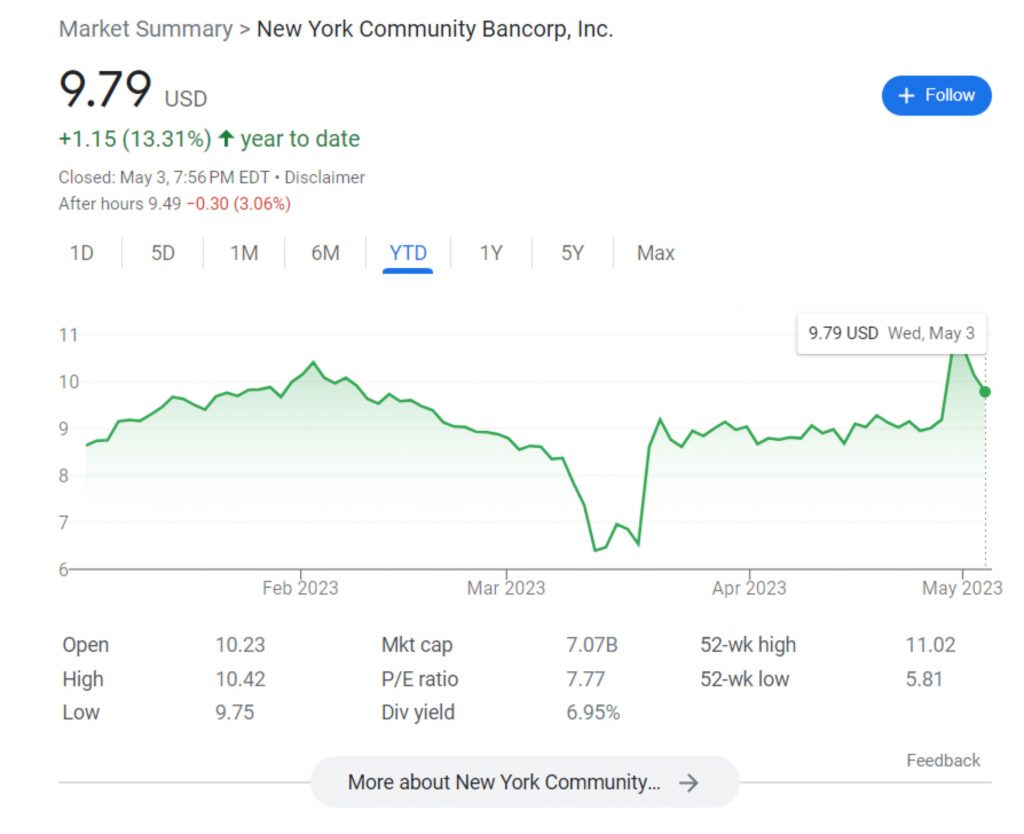

No. 1: New York Community Bancorp (NYSE:NYCB): SA Quant rating 4.65 and Wall Street analyst rating 4.23.

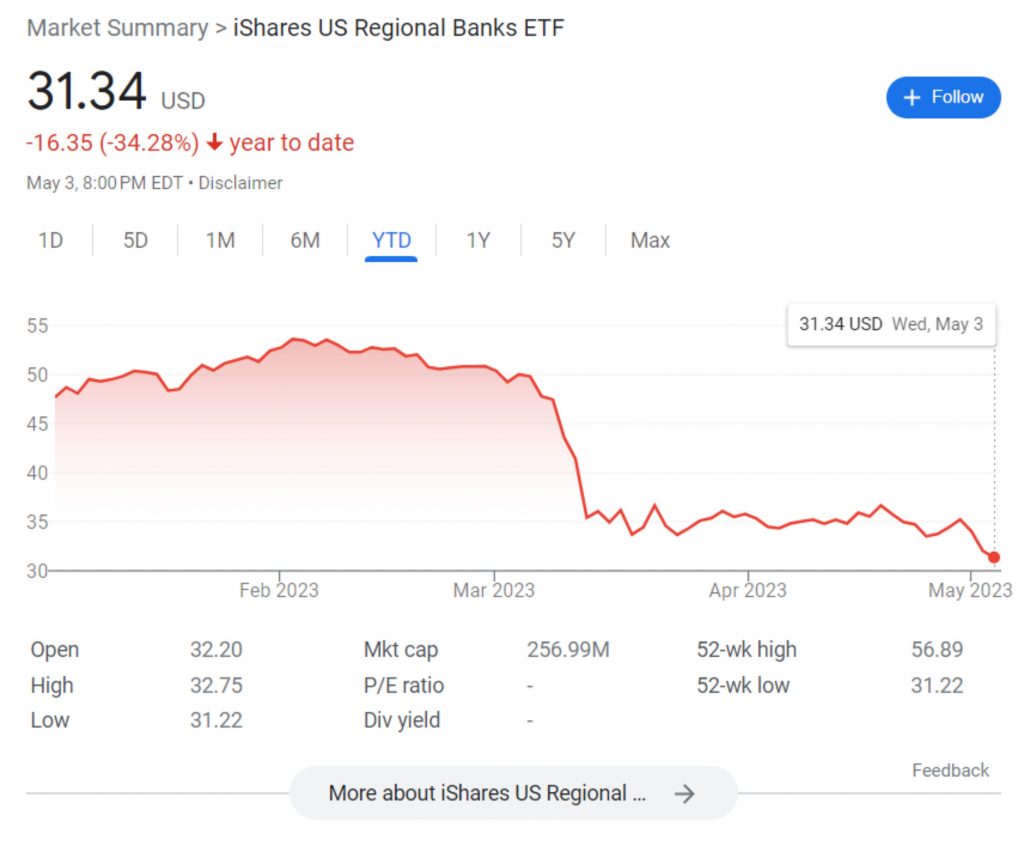

We can also look at the iShares US Regional Banks ETF:

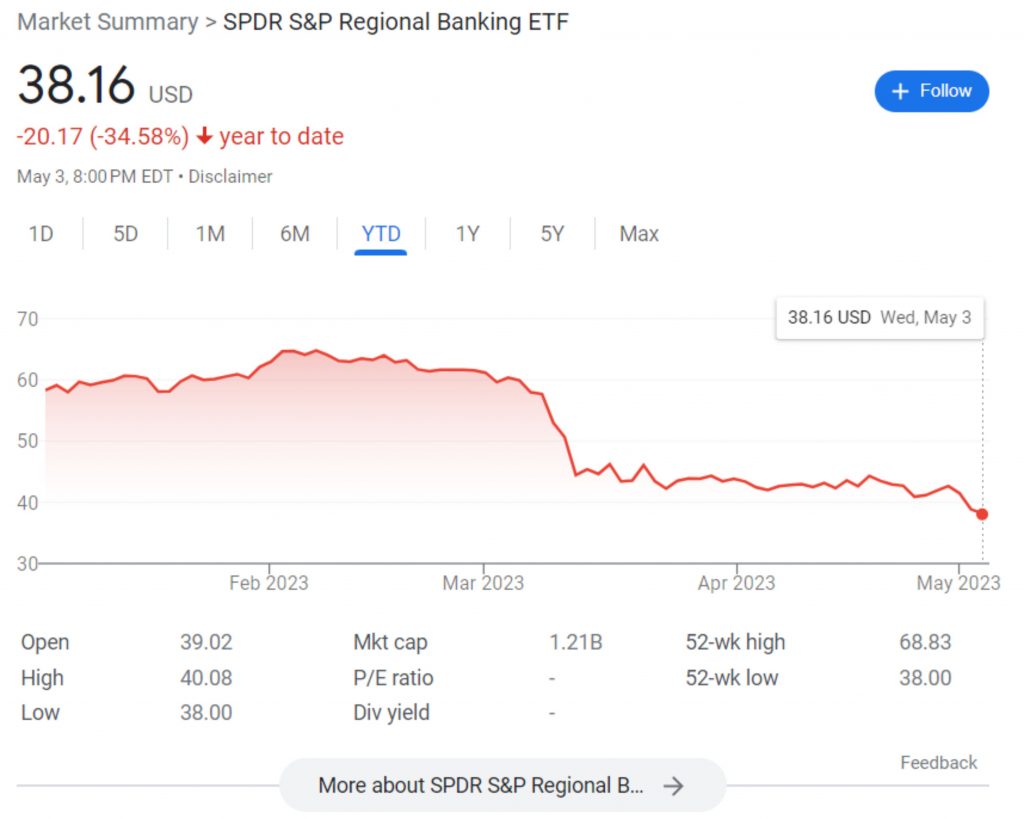

or the SPDR S&P Regional Banking ETF:

The graphs paint the same picture. Also note that most of these bank stocks are falling after the close of the market. I believe we will be waking up to some very bad news in the morning.

David DeGerolamo

Historically bank holidays occur on Thursday Evening after the bank closes as to prevent a bank run and give the Fed closer crew a weekend before the lawsuits and complaints roll in. SVD seemed to be a clumsy error OR a TEST BED to see how we would react to a bank closing so badly.

Maybe DR needs to run that YouTube about the closing team again?

Got enough storage goods to handle a 2-week credit freeze? This ASSUMES that the EBT still works as it IS Credit Card run by Banks and massive Gimme Dat riots don’t occur to cover the “Credit Card-Bank Holiday” issues.

No credit no truckers rolling as nobody carries enough cash to refuel that 4-5 MPG Semi truck.

See this for what happens when the trucks stop (and it doesn’t cover 2nd and 3rd order issues like Gimmie Dat riots destroying important things like setting building ablaze and destroying power lines).

INFOGRAPHIC: Find Out What Would Happen If Trucks Stopped (fueloyal.com)

As Papa Hemmingway said in the Sun also rises.

“How did you go broke? Slowly then suddenly. And I had lots of friends and creditors. I had more creditors than England”.

Interesting times as the Chinese Curse says. Hey what’s the weather for a Taiwan Invasion in the near future? Maybe the timing is “Fortuitous” as the Chinese might say.

Protect your family and trusted friends. Far more valuable in “interesting times” than fiat money.

Somewhere the Democrats are high-fiving each other and celebrating this collapse. They want it to consolidate banking power and force CBDC.

BTW, Chase bank near me has started shutting down ATM’s once the bank closes and the bank hours have conveniently been slashed by a few hours. They stopped letting people swipe your card for access to it inside after hours.

I agree that this is a planned takeover of the commercial banks to facilitate the implementation of the CBDC system. I disagree that it is only the Democrats who want this.

There is only one party and we are not invited.

Nice work on this sequence of charts. I agree, tomorrow forward is going to be pretty grim.

Great post. Thank you

Look up

FAZ

JPM

you’re welcome.

Thanks David.

Thank you again for the wealth of info you provide. Looking at all charts it appears something of interest happened late March 23. I am quite ignorant to financial markets, can you help with pointing out or even speculating what may have happened in that time frame?

Silicon valley bank collapsed.