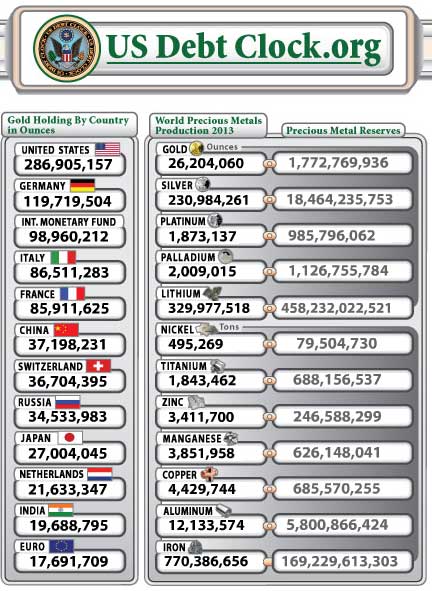

Although the amount of gold redistributed from Cyprus to Germany/IMF (as outlined in the article below ) is not large in the grand scheme, it is indicative of the plan being implemented for other countries. Italy should be up next and whether the United States has any gold left is unknown. The last audit done by the now infamous accounting firm of KPMG, was certified over fifteen years ago and did not include any physical inspections. As Germany has found out, retrieving their gold from the Federal Reserve is proving to be difficult.

David DeGerolamo

Here We Go: Cyprus To Sell €400 Million In Gold, About 75% Of Its Total Holdings, To Finance Part Of Its Bailout

Curious why every bank and their grandmother, and most recently Goldman today, has been lining up to push the price of gold as low as possible? Here’s why:

- CYPRUS TO SELL 400 MLN EUROS WORTH OF GOLD RESERVES TO FINANCE PART OF ITS BAILOUT – TROIKA DOCUMENTS – RTRS

Or about 10 tons of gold. But… the bailout was prefunded and there was no need to provide any additional cash? What happened: was the deposit outflow discovered to have been even greater than the worst case scenario and thus Cyprus needed even more cash? As for the buyers? We will venture a guess: central banks buying at the lows.

Finally: congratulations Cypriots. You are now handing over your gold for the one time, unbeatable opportunity to remain a vassal state to the Eurozone. But at least you have your €.

The good news: Cyprus will have at least another 4 or so tons after selling the 10 demanded now, before the Troika kindly requests that Cypriot citizens sell a kidney or two to pay for the ongoing deposit outflow from its insolvent banks, and indirectly, the endless bailout of the Euro.