CADD Graphics

Carolina Readiness Supply

Websites

NC Renegade on Twitter

NC Renegade on Gab

NC Renegade on Truth Social

Wes Rhinier on Gab

12 Round Blog

Barnhardt

Cold Fury

DanMorgan76

Defensive Training Group

The Deth Guild

The Feral Irishman

First in Freedom Daily

Forloveofgodandcountry's Blog

Free North Carolina

Knuckledraggin My Life Away

Liberty's Torch

90 Miles From Tyranny

Professor Preponomics

Publius-Huldah's Blog

Straight Line Logic

The Tactical Hermit

War on Guns

Western Rifle Shooters Association

Categories

-

Recent Posts

Recent Comments

- Priscilla King on Should Erika Kirk Forgive Her Husband’s Killer?

- Priscilla King on Should Erika Kirk Forgive Her Husband’s Killer?

- GenEarly on All Good Things

- David on No Mercy: Woke Leftists Are The Problem And They Need To Go

- Andrew on All Good Things

Archives

Meta

Here We Go

OPEC+ Makes Surprise 1 Million-Barrel Oil Production Cut

OPEC+ has unexpectedly announced an oil production reduction of over 1 million barrels per day, limiting output from May. Saudi Arabia spearheaded the cartel’s efforts by committing to a 500,000-barrel reduction of its own production.

According to the Saudi Press Agency, a Ministry of Energy official stated the Kingdom of Saudi Arabia will “implement a voluntary cut of 500 thousand barrels per day from May till the end of 2023.”

The cut will be in coordination with other OPEC and non-OPEC participating countries in the declaration of cooperation, the state-run media outlet continued.

UPDATE:

~~~~~~~~~~~~~~~~~~

Coming his week: energy inflation, more bad news from the financial/banking industry, the fall of Bakhmut and more disinformation from the illegal government.

David DeGerolamo

Posted in Editorial

9 Comments

Faith in the Lord’s Righteousness

Psalm 11

1In the Lord I put my trust;

How can you say to my soul,

“Flee as a bird to your mountain”?

2 For look! The wicked bend their bow,

They make ready their arrow on the string,

That they may shoot secretly at the upright in heart.

3 If the foundations are destroyed,

What can the righteous do?

4 The Lord is in His holy temple,

The Lord’s throne is in heaven;

His eyes behold,

His eyelids test the sons of men.

5 The Lord tests the righteous,

But the wicked and the one who loves violence His soul hates.

6 Upon the wicked He will rain coals;

Fire and brimstone and a burning wind

Shall be the portion of their cup.

7 For the Lord is righteous,

He loves righteousness;

His countenance beholds the upright.

Posted in Editorial

3 Comments

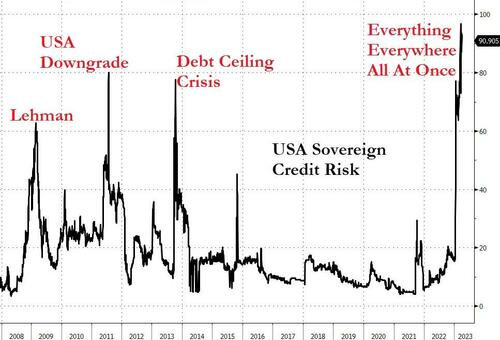

Everything, Everywhere, All at Once

Debt Deflation: “The Adjustment To Reality Is Likely More Violent Than Anything Seen In The ’70s”

The theme of this article is debt deflation. How likely is it that the downturn in broad money supply will continue, and if so, why? And what are the consequences?

The major central banks have increasingly resorted to interest rate management as their principal means of demand management. Yet history shows little correlation between managed interest rates and the growth of credit, which is represented by broad money statistics.

It can only be concluded that central banks have finally lost control over interest rates, and that they are now being driven by the contraction of commercial bank credit. The great unwind of the credit bubble, which was four decades in the making, is being driven by a growing fear of lending risk among bankers, exacerbated by the recent failures of a few significant banks. For bankers, it is no longer a time for greed, but for fear and a reduction of their debt obligations.

~~~~~~~~~~~~~~~~~~~~

In case you missed it, the title of this article comes from the graphic above. There is an important point that the author missed: the only way out of this economic collapse is war. Unfortunately, this war will not consist of small skirmishes or proxy wars. This war may well be a nuclear conflagration in which the United States will lose.

I have often stated the hope is not a strategy. People that I have asked concerning a world war usually respond with “we have weapons that you don’t know about”. Not only is this a misplaced hope, it is based on no facts. While the rest of the world that is aligning against us has been building and surpassing our military in both manpower, equipment and technology, our “leaders” have been funding gender fluid propaganda, protecting their brown shirts (Antifa) and transurrectionists, poisoning our people and military with mRNA “vaccines” and attacking free speech as misinformation. Their roosters have now come home and we are the ones who will pay the price for their treason, immorality, greed and enslavement.

No one has all of the answers but we can still prepare. Food, seeds, fertilizer, precious metals and tools are all more valuable than fiat dollars sitting in a bank collection 0.01% interest. Place your trust in the Lord with all of your heart and listen to the examples that He has laid out in the Bible concerning preparations and charity.

David DeGerolamo

Posted in Editorial

12 Comments

India, Malaysia move beyond dollar to settle trade in INR

India and Malaysia have agreed to settle trade in the Indian rupees, the Ministry of External Affairs announced on on April 1, 2023.

The announcement came in the backdrop of ongoing official efforts to Safeguard Indian trade from the impact of Ukraine crisis. The shift away from The U.S. dollar which has been the dominant reserve currency for international trade so far has added significance as it indicates India is willing to take concrete steps towards de-dollarisation of its international trade.

The Union Bank of India in a statement said that it has become the first bank in India to operationalise this option by opening a Special Rupee Vostro Account through its “corresponding bank” in Malaysia — India International Bank of Malaysia.

“Trade between India and Malaysia can now be settled in Indian Rupee (INR) in addition to the current modes of settlement in other currencies. This follows the decision by the Reserve Bank of India in July 2022 to allow the settlement of international trade in the Indian Rupee (INR). This initiative by RBI is aimed at facilitating the growth of global trade and to support the interests of the global trading community in Indian rupees, “ the Ministry of External Affairs announced.

Posted in Editorial

11 Comments

Saudi Arabia Joins Shanghai Cooperation Organization As It Embraces China

While the US continues to splinter and cannibalize itself as it turns into a third world country, China is expanding its zone of economic and military influence that covers virtually all global commodity producers as it prepares for the next stage in the Sino-US cold war.

On Wednesday, Saudi Arabia’s cabinet approved a decision to join the Shanghai Cooperation Organization, as Riyadh builds a long-term partnership with China despite – or perhaps due to – US security concerns. Saudi Arabia has approved a memorandum on granting the kingdom the status of a dialogue partner in the Shanghai Cooperation Organization (SCO), state news agency SPA said.

The SCO is a political and security union of countries spanning much of Eurasia, including China, India and Russia. Formed in 2001 by Russia, China and former Soviet states in Central Asia, the body has been expanded to include India and Pakistan, with a view to playing a bigger role as counterweight to Western influence in the region. Iran also signed documents for full membership last year.

Consider the Implications

A Historic Quarter for SD Bullion and Current Business Update

Thanks to our amazing customers and partners, SD Bullion has seen significant growth throughout the entire Q1 of 2023. In what was a steady market, we offered best in market value via competitive premiums as buyers were less active than usual. Our customers responded overwhelmingly, clearly supporting the decision to reduce premiums where we were able to do so. The leadership of this company invests in precious metals personally, so we understand the value of affordable physical.

As we have grown, we have continued to hire as many people as possible to join our team and service the business. While we’ve been successful in some ways, we admit that what we have done has not been enough to prepare for what occurred in early March.

On March 10th, we all woke up to the news of the Silicon Valley Bank collapse; which sent a ripple effect through investors worldwide. There has been and continues to be a massive influx of demand as savvy investors are now evaluating counterparties, including banks, in a more scrutinizing fashion. The takeaways from the banking collapses have been clear: you don’t own what you don’t hold. As a company, we went from “extremely busy, but keeping up” to “all hands on deck” overnight. Orders came in waves, and the amount of metal per order more than doubled. The bottom line is bigger orders take longer to ship than smaller orders.

This perfect storm has created very difficult challenges in the short term at SD Bullion, both internally (our phone queues flooded with calls that there simply aren’t enough man hours to answer) and externally (customers are experiencing delays outside of our normal shipping time frames as we endeavor to push out every order possible daily).

We have been aggressively hiring since mid-February and we continue to do so. We’ve raised wages, offered higher signing and referral bonuses, and restructured teams to maximize available support to shipping and phone teams. Everyone at SD Bullion, top to bottom, has been diligently working to get us out of this hole. In short: it has simply not been enough and we continue to under-deliver in ways that we won’t accept.

To our customers, we hear your frustration with the delayed shipments. We share that frustration and will not slow down until it’s remedied in full and we have scalable solutions in place to prevent it from happening again. There’s a lot we’ve learned from this experience. We are the fastest growing bullion dealer in the world; we thank our customers as they are responsible for that growth. As a company, we’re pushing through growing pains and we will continue to improve in every way that matters to our customers.

Where Do We Stand Today?

As we write this we are currently 7+ business days behind our normal shipping time (which is 1-3 business days after your payment clears our account). For the time being, we’re pausing additional planned promotional (“On-Sale”) activities while we focus all attention on servicing existing orders in the system. Also, we’re temporarily raising the minimum order total required for new orders to $500.00 USD. This will allow us to better deliver on all orders and reach operational efficiencies faster.

We plan to post an update here weekly until we get back to the standard service and shipping experience our customers have come to enjoy for more than 10 years now.

Thank you to everyone’s support and patience with us. If you’ve placed an order with us; you will receive it in full, it just might take a few extra days for us to get it out the door. For that, we deeply apologize for it taking longer than it should.

Sincerely,

SD Bullion Executive Team

Posted in Editorial

5 Comments

Operation Sand Man Part III

The following excerpts are from an article cited on Western Rifle Shooters Association. Please read the entire article.

Bullet Points:

I think there is a strong possibility, say 50-75% chance, that Operation Sand Man will go live on Thursday, April 6, 2023, late at night (early the next morning for most other countries), +/- 12 hours. I came up with this date based on the fact that the USA will be going into a national holiday weekend, and be shut down for 3 days for Easter observance. As a sneak-attack, it would prevent the US government from formulating a rapid response to the situation, for at least four calendar days, by which time it would be a “done deal.”

~~~~~~~~~~~~~

“When that happens- and it will- the price of imported goods will go through the roof almost overnight, as every country will attempt to get rid of their dollars while they still can, and use some other currency for international trade.

The dollar will be dumped as the world’s reserve currency, in a cascade as other countries holding dollars run for the exits. When this happens, the price of products that are imported will go up by 4-5 times, almost overnight (my best guess). This is the logical result of the Cloward-Piven strategy writ large.

~~~~~~~~~~~~~

And do you see why Biden signed an executive order to facilitate digital currencies? If your money is digital, it can be confiscated or they can at least stop you from transacting any more (cryptos).

~~~~~~~~~~~~~

Russia has been stockpiling food, and last week Putin announced to his people on Russian TV that the country had five years of food stockpiled, so they need nothing from the USA- or frankly, anyone else. China has stockpiled 18 months of wheat to feed their people, but their agents are busily moving around America buying any stored wheat they can get their hands on- by the trainload, at whatever price they have to pay- and sending it on cargo ships back to China.

The results here will be food prices going steadily up in the USA for the foreseeable future. I’m seeing 15-20% increases in the grocery stores, on a month-to-month basis, right now, and those increases will get much steeper. With no potash and already exorbitant prices for natural gas- both absolutely required to produce fertilizer for high crop yields- we’re going into a period of not just “food shortages,” like Brandon said, we’re going to be facing our own version of the Holodomor famine of 1933.

Posted in Editorial

25 Comments

Sorry

I am sorry but I will not be posting any personal opinions concerning the Trump indictments. The news cycle is saturated with talking heads expressing their views and theories on this issue.

I will continue to look at the issues and events that are being ignored by this misdirection:

- Banking sector warning: Barclays sees ‘second wave’ of deposit outflows coming. In other words, people are still taking money out of the banks and the bank runs will continue. This will expedite the government’s digital currency based on your ESG score.

- Nuclear weapons in Belarus. The probability of a nuclear war is increasing.

- North Korea tests new nuclear-capable underwater drone. A nuclear tsunami by this nation should be a high concern for everyone. One detonation would ignite a nuclear WWIII.

- Conflict in Syria Escalates Following Attack That Killed a U.S. Contractor. The United States is still fighting an illegal war in Syria.

- China And Brazil Strike Deal To Ditch The US Dollar. The end of the petrodollar will collapse our economy and wealth.

The above short list of what we should be focusing on does not include inflation, the corrupt government agencies, the new FBI headquarters, the statistics showing the vaccine deaths, disabilities and injuries, the Nord Stream coverup, the collapse of Ukraine or Joe Biden’s dementia.

Being quiet and watching allows us time to prepare for a bleak future. Putting my faith in the Lord is what I was directed to do. I believe the Lord will intervene against this evil and when He does, it will be a decisive strike. Will we wait? It gets harder every day to sit and be quiet.

David DeGerolamo

Posted in Editorial

10 Comments

Vice President Harris Announces Over $7 Billion in Private Sector and U.S. Government Commitments to Promote Climate Resilience, Adaptation, and Mitigation across Africa

In Lusaka, Zambia, in response to Vice President Kamala Harris’s call for the private sector to promote and enhance climate resilience, adaptation and migration across Africa, the private sector made over $7 billion in new commitments. Additionally, the U.S. Government is announcing new federal funding and initiatives to expand access to climate information services and enhance climate resilience and adaptation. These new investments and initiatives will generate significant economic benefits while addressing African nations’ pressing needs resulting from the climate crisis, including food security challenges, by helping to lift-up over 116 million farmers and promote climate-smart agriculture. These announcements demonstrate America’s commitment to partnering with African people and governments, alongside the private sector, to help the continent meet its climate adaptation and resilience, clean-energy access, and just energy transition goals.

Posted in Editorial

15 Comments